Buying Dubai Medical Insurance Online made Quick, Easy & Affordable.

A simple and easy 3 step process to get your Medical Insurance online.

While saving your Time, effort, and money.

Google Rating

- 4.7

Mobashar Hussain I had a great experience with Insurancehub. It is so easy to reimburse your claims with them. I would call their customer service team for help and they have been responsive and they care about your inquiry. Thank you Insurancehub team!

Alka Edvin Insurancehub provides good customer service and they really care about their clients. I was able to talk to Mr. Jibin, he helped to understand my case, my benefits and also explained the process of taking approvals. Thank you Jibin for helping me.

Anas Maqbool Great service from team Insurancehub. They were very helpful and promptly updated my documents without any hassle. The teams very helpful and replying patiently to all my queries with atmost professionalism. Kind regards, Anas Maqbool.

Get Recommendation After submitting the form we will connect you to one of our Insurance advisors that would recommend you the Most affordable Insurance plan according to your needs.

Our In House experts do that task for you and it hardly takes a couple of minutes ( Depending on your needs ) for them to advise you on the best insurance that fits your needs

Compare and Buy This is the final and most easy step. Choose from the list of recommended products( Our Advisors will also help you out ) and Buy directly.

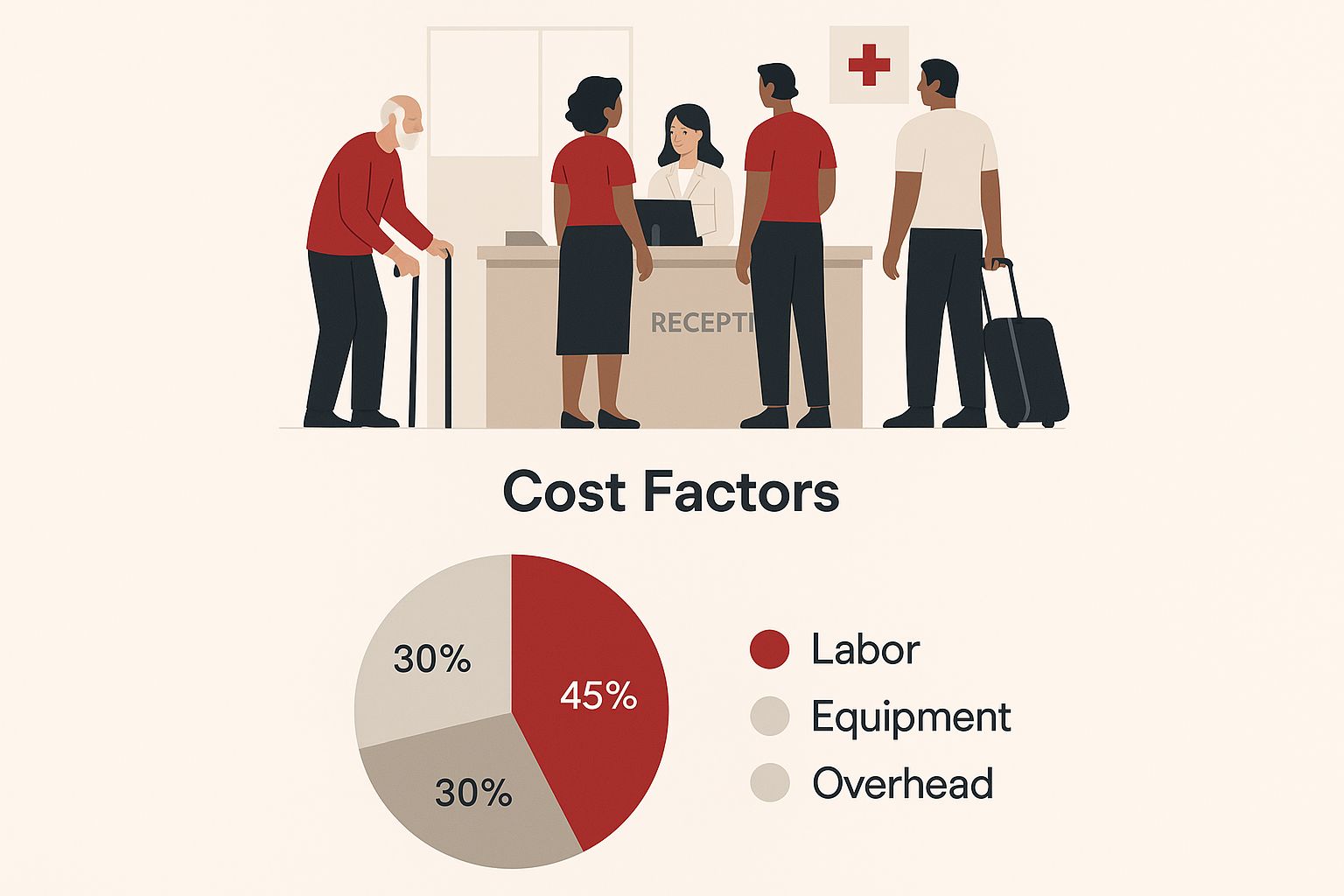

Dubai's mandatory medical insurance has created a unique market, with legal requirements heavily influencing pricing. To choose the right plan, it’s important to understand the key factors driving premiums—not just to meet regulations but to ensure proper coverage.

Residency status is a major cost factor. Emiratis receive free public healthcare, while expats must have private insurance, affecting both pricing and plan types. Age and pre-existing conditions also influence premiums, often requiring specialized and more expensive coverage.

In recent years, Dubai and the UAE have seen significant insurance cost hikes. In 2024 and 2025, private medical premiums rose sharply, with projections of 10%–20% increases. The WTW Global Medical Trends Survey reported a 12% regional average increase for 2025—mainly due to higher healthcare costs, frequent claims, and the removal of pandemic-related discounts

Understanding Dubai's medical insurance costs also requires grasping the minimum coverage standards. The mandatory Basic Health Insurance package costs AED 320 annually. While this provides a baseline, it often includes co-payments and coverage limits, potentially leaving significant gaps in protection. Many expats choose to supplement this basic plan with additional coverage for more comprehensive care. Recognizing the difference between meeting the minimum legal requirements and securing adequate protection is crucial when evaluating your Dubai medical insurance options. This understanding is key to protecting both your health and your finances.

Navigating Dubai's medical insurance market can feel overwhelming. Understanding actual plan costs is key. Beyond advertised prices, let's explore what individuals typically pay for various coverage levels. The difference between basic, legally mandated coverage and a comprehensive plan can be substantial, impacting both your health and finances.

Basic plans, often the minimum required by law, may seem attractive due to lower premiums. However, they often come with limitations. These can include restricted access to hospitals and specialists, high co-payments, and exclusions for certain treatments. While your initial cost is lower, unexpected out-of-pocket expenses can arise when you need care. Comprehensive plans, though more expensive upfront, offer broader network access, lower co-payments, and coverage for a wider array of medical services. This offers greater peace of mind and potentially lower long-term healthcare costs

Network size significantly impacts both cost and quality of care. Larger networks offer greater choice and potentially higher-quality specialists but typically come with higher premiums. Smaller networks limit options but might be more budget-friendly. Hospital tiers also play a crucial role. Treatment at Tier 1 hospitals, renowned for their advanced facilities, typically costs more than Tier 2 or 3 facilities. Choosing a plan covering your preferred hospitals and doctors is essential

Premium features like international coverage and specialized care can increase your premium but add real value. If you travel frequently or have specific health concerns, ensure your plan meets those needs. Budget plans may include hidden limits—like minimal pre-existing condition coverage or service caps -so read carefully. For group coverage

Also Read: Group Private Medical Insurance in Dubai

Annual private medical insurance in Dubai ranges from AED 500 to over AED 20,000 per person. Basic plans start from AED 500–1,500, mid-range from AED 3,000–7,000, and premium plans can exceed AED 10,000. For detailed stats, refer to the full resource.

Dubai Medical Insurance Plan Comparison: A clear look at various plan tiers, pricing, and coverage options in one table.

| Plan Type | Price Range (AED) | Price Range (USD) | Coverage Features | Network Size | Best For |

|---|---|---|---|---|---|

| Basic | 500 - 1,500 | 136 - 408 | Limited hospital access, high co-pays, basic treatments | Small | Individuals on a tight budget |

| Mid-Range | 3,000 - 7,000 | 817 - 1,906 | Wider hospital access, lower co-pays, more treatments covered | Medium | Families and individuals seeking balanced coverage |

| Premium | 10,000+ | 2,722+ | Extensive hospital access, low co-pays, comprehensive coverage, international options | Large | Individuals and families seeking maximum coverage |

Cheapest Medical insurance in uae | Medical insurance in uae| Cheapest Mediacl insurance uae | Best Medical insurance in uae | Best Medical insurance in uae | Cheapest Medical insurance in uae

Most of our First Time customers couldn’t believe that Buying Insurance Online is as simple and affordable.

We help you to get the Best Deal on any Insurance at a very affordable price ( Insurancehub. ae Customers save almost up to 40% as compared to others )

Save more than you expect. Our Insurance Advisors will help you to find the best deals that will save you not only cover all your needs but would help you save a lot of your Money, Time, and Effort.

Saving is the Ultimate Mantra…

We just don’t treat our customers as Just customers rather friends. And Insurancehub is that friend who will never forget you whenever you’re in Need. We take this part of our Operations were carefully so that you get a seamless experience.

Still not able to decide whether Insurancehub would be a good fit for you or not.

Fill out the form Complete the basic form that hardly takes 3 mins of your time.