Navigating Family Health Insurance in the MENA Region

Finding the right

health insurance for your family can be a complex process, especially in the Middle East and North Africa (MENA) region. Healthcare systems differ significantly across countries, making it essential to understand the nuances of each to ensure adequate coverage for your loved ones. This guide breaks down the intricacies of

family health insurance in the MENA region, helping you make informed decisions

Family Plans vs. Individual Coverage

One of the first steps is understanding the core difference between family and

individual health insurance plans. Individual plans cover only one person, while family plans extend coverage to your spouse and children. This combined coverage often leads to cost savings and simplified administration.

To illustrate these differences, let's take a look at a comparison table:

Understanding the distinctions between family and individual plans is crucial for selecting the best option for your family's needs. The following table summarizes the key differences:

| Feature

| Family Plans

| Individual Plans

| Benefits for Families

|

|---|

| Premium

| Higher than individual plans

| Lower

| While the overall premium is higher, the per-person cost is generally lower.

|

| Coverage

| Covers all listed family members

| Covers only one individual

| Everyone receives the same level of protection.

|

| Deductible

| One deductible for the family

| Individual deductible

| Reaching the family deductible unlocks benefits for all members concurrently.

|

| Administration

| One policy to manage

| Multiple individual policies

| Simplified billing and policy management.

|

This comparative overview highlights the advantages of family plans, particularly concerning cost-effectiveness and streamlined management. Combining everyone under one policy simplifies administration and can often save money in the long run. This unified approach is particularly beneficial for managing family healthcare expenses and ensures everyone has access to the necessary care.

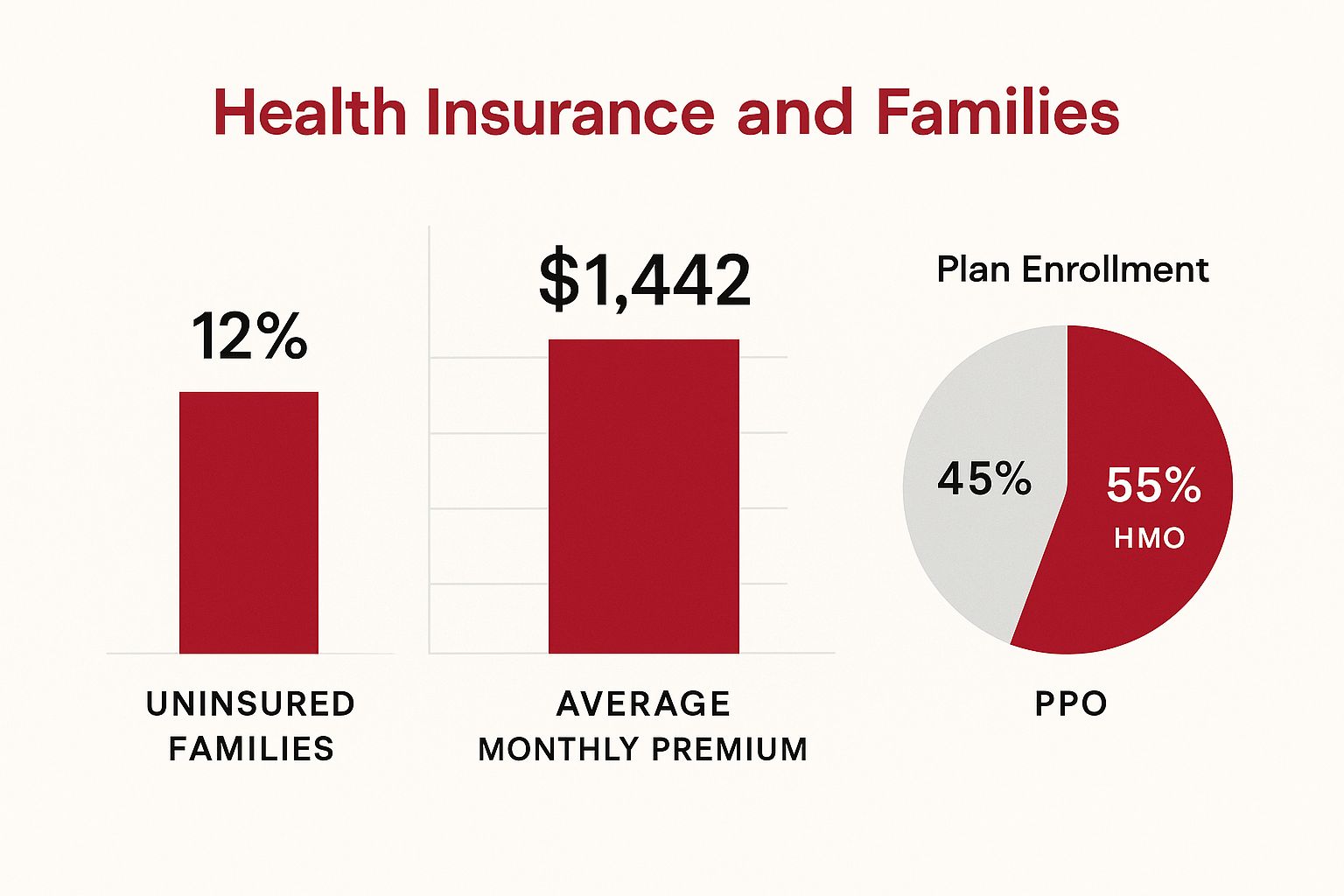

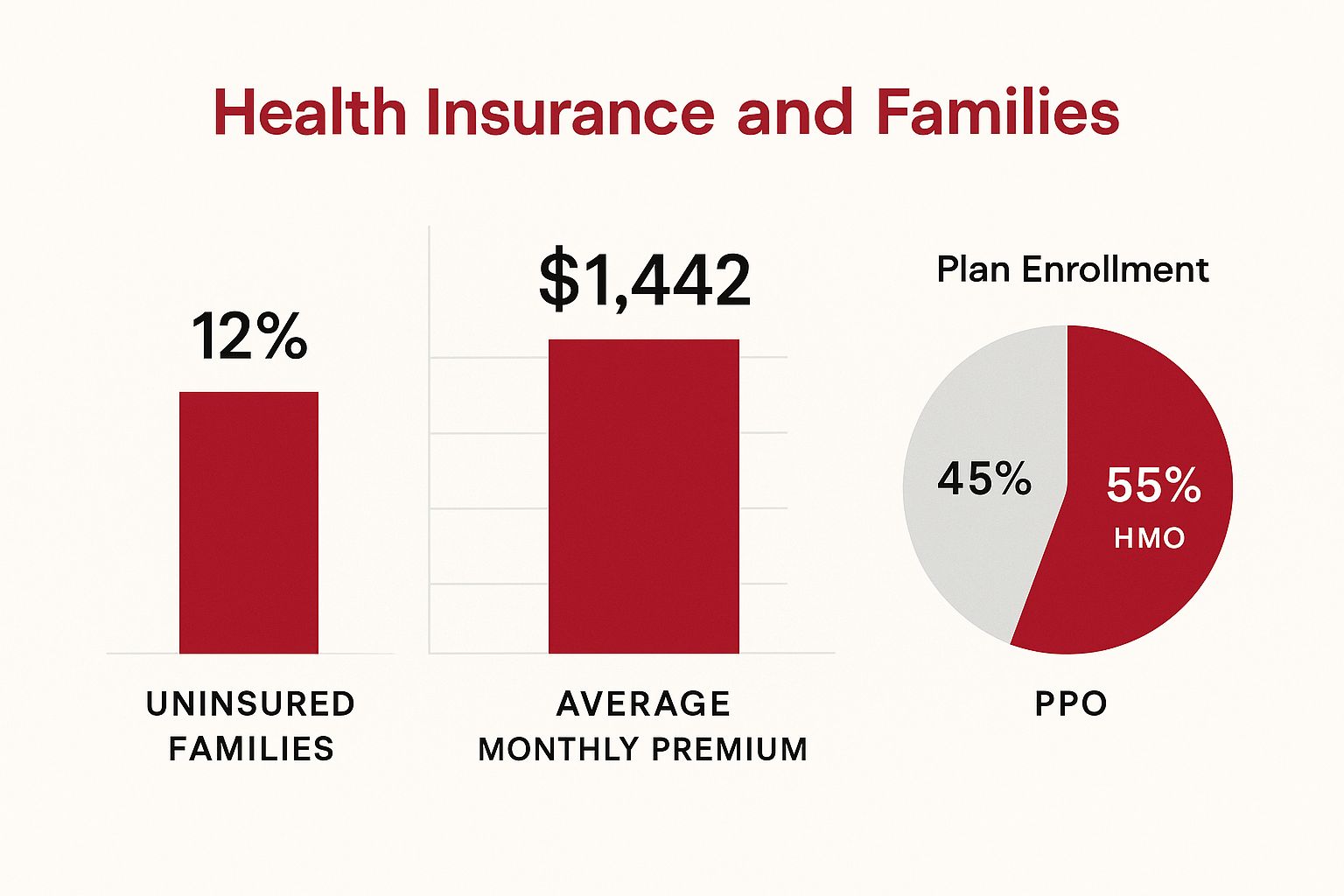

The MENA region's health insurance market is experiencing significant growth, emphasizing the increasing need for family coverage. The infographic below highlights current trends:

The infographic showcases key concerns, including the number of uninsured families and the cost of premiums. This data underscores the need for more accessible and

affordable health insurance options within the region.

Furthermore, market projections indicate robust growth in the health insurance sector. By 2025, the MENA health and

medical insurance market is expected to reach USD 18.47 billion, growing further to USD 25.64 billion by 2030. This expansion is driven by factors like increased awareness of health insurance, a rise in chronic illnesses, and higher disposable incomes. You can find more details on this market growth at Mordor Intelligence. This growth underscores the rising demand for comprehensive health plans, particularly those designed for families. Mandatory health insurance schemes are becoming increasingly common, particularly in the GCC, encouraging families to seek plans with a wider range of benefits.

Country-Specific Considerations

Navigating family health insurance in the MENA region requires a thorough understanding of the regulations, healthcare systems, and insurance mandates specific to each country. The diversity within the region means that what applies in one country may not hold true in another.

Here are some key points to consider when evaluating country-specific health insurance options:

- Mandatory vs. Private Coverage: Some countries, like the UAE and Saudi Arabia, have mandatory health insurance schemes for residents and workers. Others may rely more heavily on private providers without legal requirements.

- Regulatory Framework: Each country has its own insurance authority and compliance requirements, influencing policy types, claim processes, and approval times.

- Network Access: The availability of in-network hospitals and clinics varies. Check which providers are covered under your plan in your country of residence.

- Expat-Specific Rules: In many MENA countries, expatriates must secure private or employer-sponsored health insurance, which may differ from local citizen plans.

- Subsidies & Government Support: Some nations offer subsidized plans for citizens, while others do not. Understand if you're eligible for any government-backed health benefits.

Example: In the UAE, all residents (including expatriates) are required to have health insurance, with employers typically responsible for providing it. Meanwhile, in countries like Egypt or Lebanon, the responsibility may fall more heavily on individuals to secure private insurance.

This overview provides a strong foundation for understanding family health insurance across the MENA region. However, in-depth research tailored to your specific country is crucial to:

- Compare available policy options

- Ensure legal compliance

- Secure comprehensive and affordable coverage for your entire family

In the following sections, we will explore the key components of quality health insurance coverage, effective cost-management strategies, and how to tailor policies to meet your family’s unique healthcare needs.

Cheapest family health insurance | Buy Health insurance for family | Buy Best Family Health insurance| Health insurance for family | Health insurance for family UAE

.png)

.png)

.jpg)

.gif)