About

MedNet

MedNet UAE is a pioneering managed care service provider with a vast network of insured members, companies, and entities. With over two decades of experience, MedNet specializes in health risk management, offering high-quality healthcare services and financial protection against unexpected circumstances. Trusted across the MENA region, MedNet connects members to providers, manages approvals, and streamlines claims, helping individuals navigate care with clarity and confidence.

Key facts about Mednet at a glance:

- 3,500+ in-network healthcare providers (hospitals, clinics, labs, pharmacies)

- 24/7 multilingual helpline and mobile app for e-cards and approvals

- Digital claims submission with average turnaround under five working days

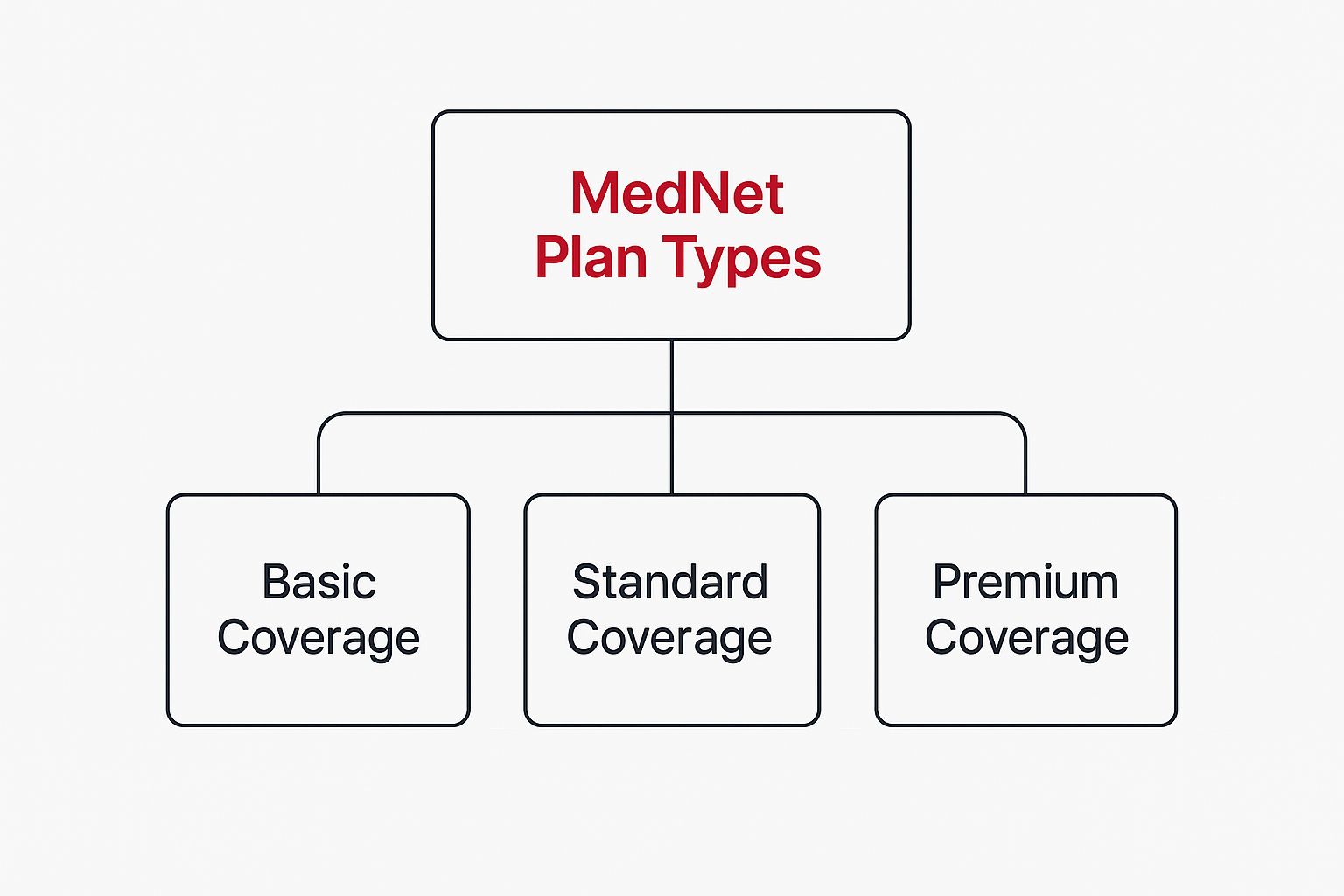

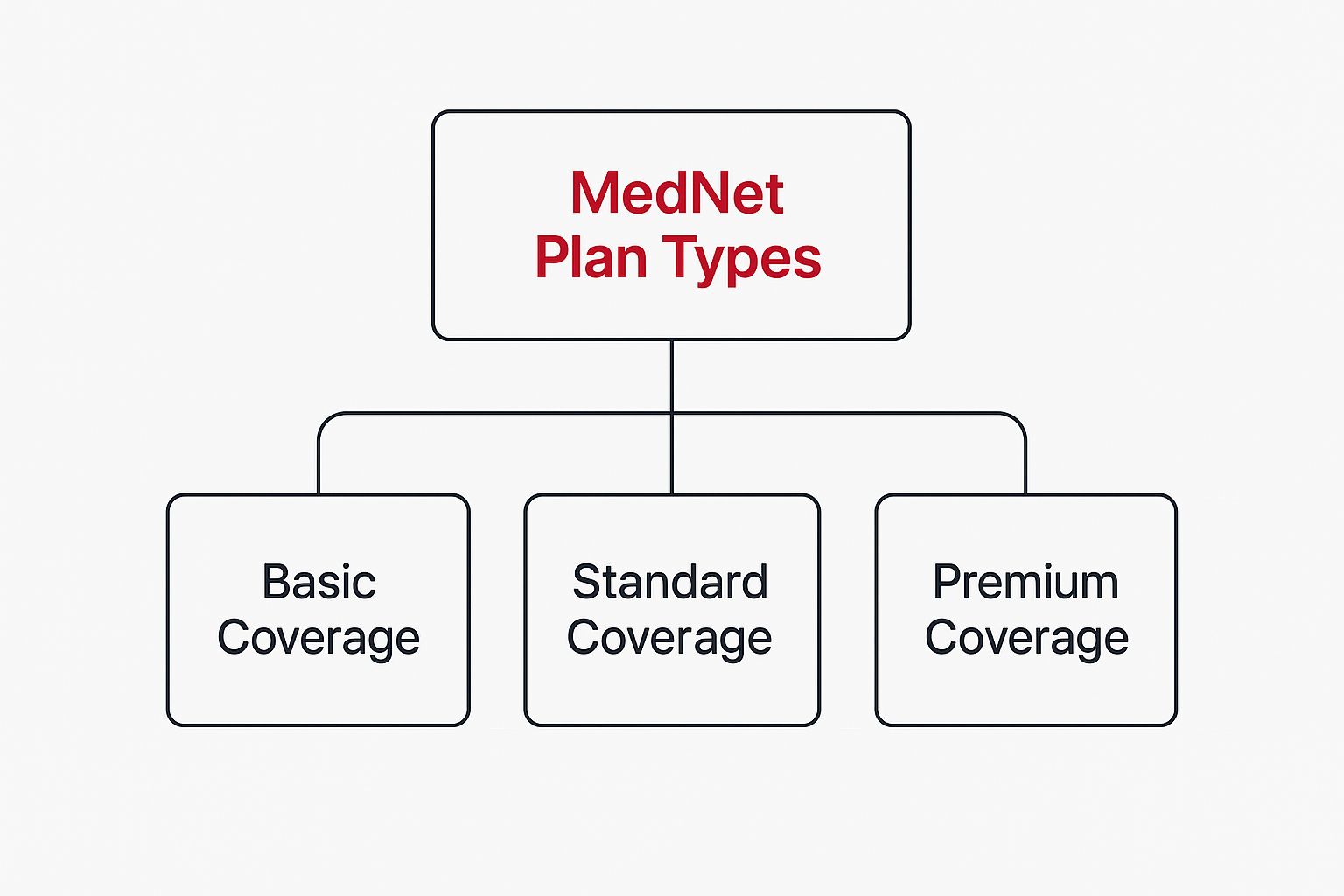

- Multiple network tiers (Silver, Gold, Platinum) so you can match benefits to budget

Who Should Consider Mednet Coverage?

- Individuals and families who value a broad hospital network with optional worldwide emergency cover.

- Small- and medium-sized companies needing tiered employee benefits at competitive group rates.

- Golden Visa holders seeking quick golden visa-stamping compliance with a Central Bank-approved network.

Why Choose MedNet Insurance Dubai?

MedNet is dedicated to facilitating high-quality, affordable managed healthcare services. Their expertise covers:

- Product design

- Medical risk evaluation

- Pricing support

- Medical and healthcare provider management

- Claims management

- Training and consulting services

Apart from being prominent healthcare providers collaborating with Munich Health, MedNet also offers sophisticated and traditional financial reinsurance products. Their managed care model combines the security of insurance with hands-on support, reducing stress and ensuring a smoother healthcare experience.

How MedNet Supports Your Care Journey

MedNet administers healthcare benefits on behalf of insurers, coordinating approvals for inpatient and outpatient services, diagnostics, and procedures. Members receive an e-card or physical card for direct billing at network facilities, minimizing out-of-pocket expenses. Non-network care is reimbursed according to policy terms.

Finding doctors, clinics, and hospitals

Provider search tools help you locate GPs, specialists, labs, and pharmacies near your home or office. When selecting a plan, verify that your preferred providers are within the relevant network tier. For planned procedures, ask whether pre-authorization is needed and what documents you should bring, such as medical reports, referrals, and past lab results.

Approvals, claims, and member services

- Approvals:

Certain diagnostics, physiotherapy sessions, and admissions require prior authorization. Submitting complete documents speeds decisions.

- Claims:

Keep original invoices and reports for any out-of-network reimbursements and submit them within the deadline.

- Assistance:

Member hotlines and portals can guide you on coverage, co-pays, and the nearest facility for your needs.

Understanding these steps reduces delays and helps you make the most of your benefits.

Services Offered at MedNet Dubai

MedNet Dubai is committed to improving the health and wellbeing of people in the UAE and beyond. Their services are designed for:

- Insurance clients

- Government health plans

- Self-funded schemes

They are known for tailor-made solutions that fit the individual requirements of clients and their markets.

Key Services:

- Administrative healthcare support

- Cheapest health insurance Dubai product design

- Medical risk evaluation

- MedNet network list management

- Training and consulting

MedNet’s TPA (Third-Party Administrator) model focuses on:

- Expense Ratio Optimization

- Business and knowledge process outsourcing

- Healthcare process optimization

- Operational reengineering

Health Risk Assessment & Management

MedNet Insurance Dubai provides in-depth support for risk mitigation and smart policy planning. Through advanced analytics and market understanding, they offer:

- Tailored

health insurance product design

- Performance-based data analysis and reporting

- Marine insurance and underwriting services

- Accurate health insurance pricing strategies

Your Complete Coverage Breakdown: What MedNet Actually Pays For

In-Network vs. Out-of-Network Care

Using in-network providers under the MedNet network is the most cost-effective option. If you go out-of-network, you may need to pay upfront and claim reimbursement later via MedNet’s online portal.

Understanding this difference helps you choose care that fits both your health needs and budget. For more details, refer to our

UAE health insurance guide.

See the table below for a quick MedNet coverage comparison by service type, patient costs, and approval requirements.

| Service Type

| Coverage Level

| Patient Share

| Authorization Required

| Network Requirement

|

|---|

| Doctor's Consultation (In-Network)

| 80%

| 20% (after deductible)

| No

| Yes

|

| Doctor's Consultation (Out-of-Network)

| 60%

| 40% (after deductible)

| Yes

| No

|

| Specialist Consultation (In-Network)

| 70%

| 30% (after deductible)

| Yes

| Yes

|

| Lab Tests (In-Network)

| 90%

| 10% (after deductible)

| No

| Yes

|

| Physiotherapy (In-Network)

| 75%

| 25% (after deductible)

| Yes

| Yes

|

| Prescription Medications (In-Network)

| 85%

| 15%

| Yes (SOAP form)

| Yes

|

| Emergency Room Visits (In-Network)

| 100% (after deductible)

| Deductible only

| No

| Yes

|

Who benefits most from Mednet insurance

- Individuals and families who value broad UAE network access

- Employees who prefer direct billing and fast approvals

- Frequent clinic users who need clarity on co-pays and limits

Knowing your expected healthcare usage helps you choose the right coverage tier.

Get help choosing a plan

For support with comparisons, provider lists, and quotes, visit

insurancehub.ae. Mednet insurance can offer a smoother healthcare experience, from everyday GP visits to specialized care, when matched with a plan that fits your needs.