The

UAE insurance market is a complex and dynamic sector. Factors like government regulations, a large expat population, and shifting economic conditions all play a role in shaping this environment. Navigating this complexity can seem daunting, but grasping the fundamentals can empower you to make sound financial decisions.

Regulatory Framework and Its Benefits

The Central Bank of the UAE plays a vital role in overseeing the insurance sector. Its primary focus is maintaining financial stability and ensuring consumer protection. These regulations benefit consumers by establishing minimum coverage standards and promoting transparency among

insurance providers. This oversight helps create a more secure environment for policyholders, safeguarding their investments.

For example, regulations mandate specific coverage levels for health and

motor insurance, ensuring a baseline level of protection for everyone. This regulatory framework fosters trust and stability within the UAE insurance market.

The Expat Influence on Coverage

The UAE is home to a diverse expat community, and this has significantly influenced the types of insurance products offered. The demand for coverage that aligns with international standards has resulted in a wider selection of options.

This is particularly noticeable in

health insurance. Many plans now cater to specific needs, like maternity care or international coverage. This adaptability makes the UAE insurance market responsive to the diverse requirements of its residents.

Market Growth and Future Trends

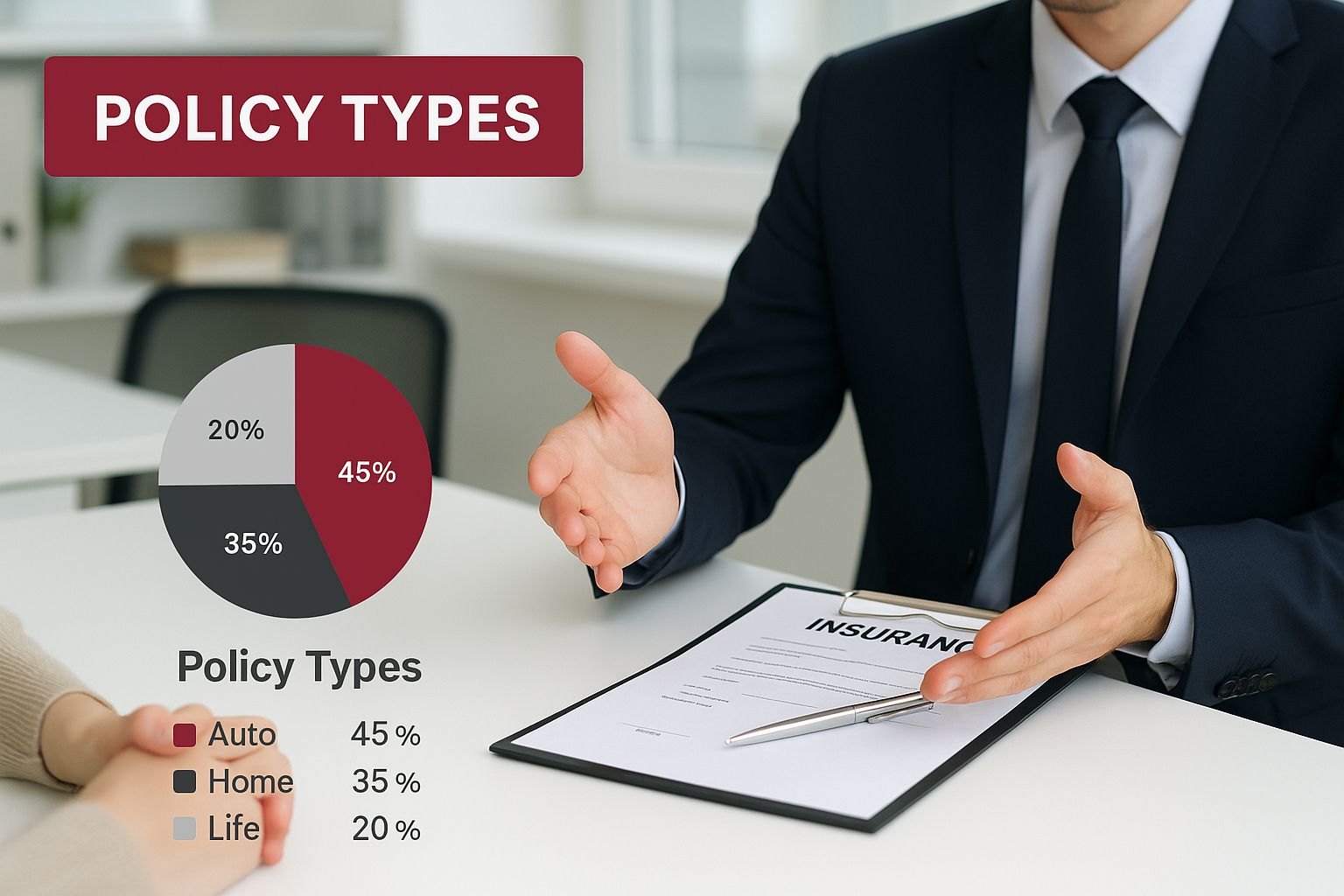

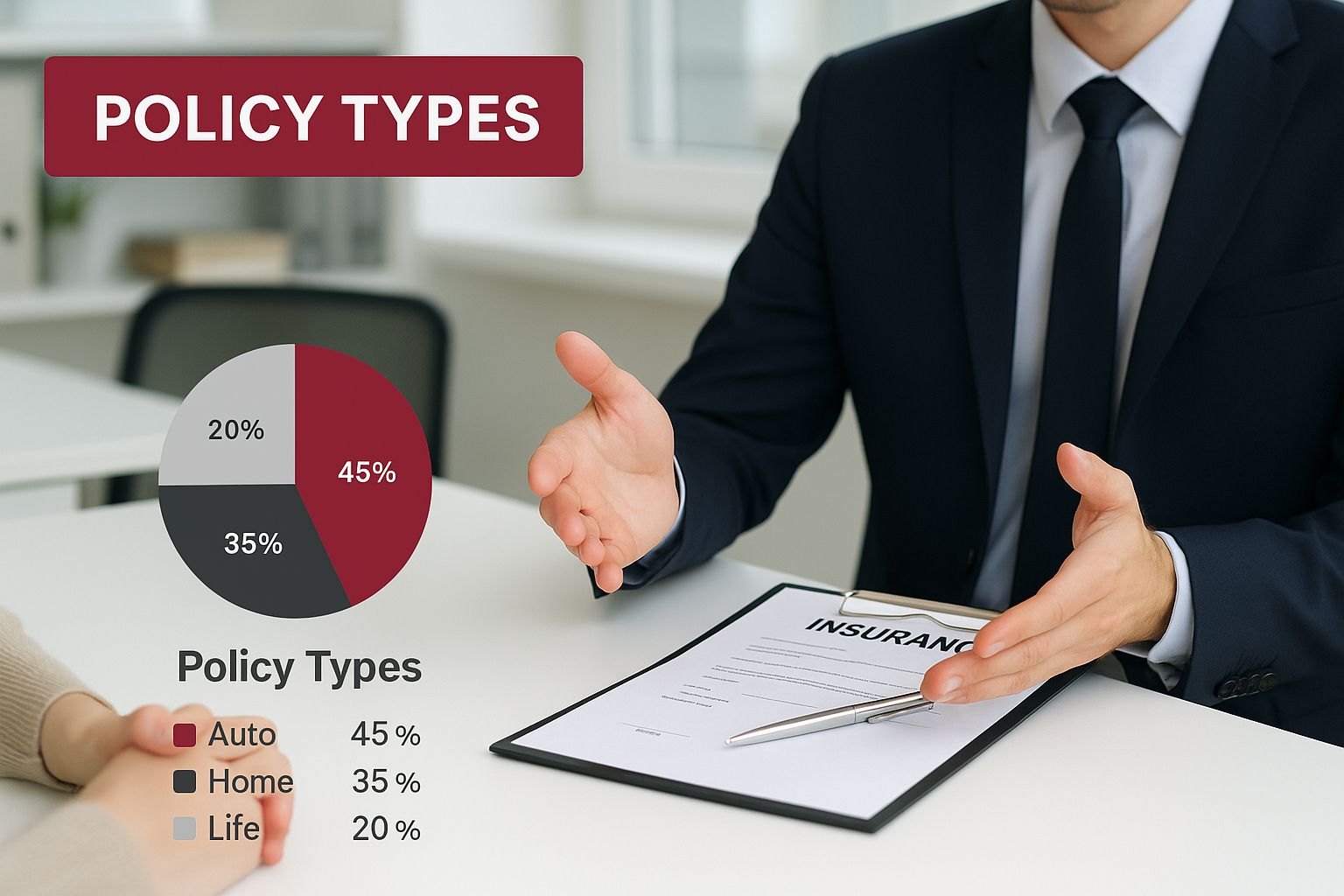

The UAE insurance market is experiencing substantial growth. Projections indicate potential growth of up to 20% in 2025, following a strong performance in 2024. This growth is driven by factors like digital innovation, strategic mergers and acquisitions, and a resilient response to climate-related challenges.

Find more detailed statistics here

This positive trajectory suggests more competitive pricing and continued development of innovative insurance products for consumers.

Importance of Understanding the Landscape

Understanding the UAE insurance landscape is not just about meeting legal requirements; it's about safeguarding your financial well-being. Consider a resident facing a sudden medical emergency. Having adequate health insurance can be the difference between manageable expenses and overwhelming debt.

Similarly, in a car accident, sufficient motor insurance can prevent significant financial strain. These situations highlight the importance of selecting the right coverage for your specific needs. Understanding the landscape allows you to adjust your insurance strategy as your life changes, ensuring ongoing protection for your family and assets.

Health Insurance Requirements That Actually Matter

Mandatory Versus Recommended Coverage in the UAE

Health insurance in the UAE is both a legal requirement and a vital safeguard. While basic coverage satisfies the mandatory requirements, understanding the distinctions between basic and comprehensive plans is essential. These differences can have a profound impact on your healthcare experience. Dubai's mandatory health insurance scheme, for example, differs from Abu Dhabi's, impacting the quality and accessibility of medical services. For more information on Abu Dhabi's group medical insurance, see this helpful resource:

How to master Group Medical Insurance in Abu Dhabi.

Basic plans may restrict your choices regarding hospitals and doctors. Comprehensive plans often offer greater flexibility and access to a broader network of providers. This flexibility becomes particularly important when considering specific healthcare needs or specialized treatments. The way different emirates handle pre-existing conditions is also a key factor for many residents.

Navigating Network Restrictions and Waiting Periods

Understanding network restrictions is paramount when choosing a

health insurance plan in the UAE. Some plans limit your access to specific hospitals and clinics within their network. Others provide more extensive choices, often at a higher premium. Carefully consider your healthcare needs and budget to make the best decision.

Waiting periods also play a significant role, especially for procedures like maternity care or coverage for pre-existing conditions. These waiting periods can range from several months to a full year. Such delays can impact your access to vital services. Being unaware of these limitations could lead to unexpected expenses.

Also Read:

Waiting Period in Health Insurance – Dubai

Upgrading Beyond Basic Coverage: Real-World Scenarios

While basic coverage fulfills the legal requirements for insurance in the UAE, upgrading to a more comprehensive plan offers enhanced peace of mind. Consider a situation requiring emergency care where your basic plan doesn't cover your preferred hospital. This scenario highlights the potential risks of relying solely on mandatory minimum coverage.

Families facing significant medical expenses often discover the limitations of basic plans. Many express a wish for more comprehensive coverage, having experienced the financial strain firsthand. The UAE health insurance market is projected to reach USD 14.9 billion by 2033, expanding at a CAGR of 6.1% between 2025 and 2033. This growth reflects the increasing awareness of and demand for better health coverage. You can find more details on this market growth here:

UAE health insurance market growth. The financial industry, including insurance, operates under strict regulatory guidelines. For insights into banking compliance, see:

Regulatory Compliance for Banks.

Health Insurance Coverage Comparison by Emirate: This table provides a comparative analysis of mandatory health insurance requirements, minimum coverage levels, and key benefits across UAE emirates.

| Emirate

| Mandatory Coverage

| Minimum Benefits

| Annual Premium Range

| Network Hospitals

|

|---|

| Dubai

| Yes, for all residents

| Basic coverage including consultations, hospitalization, emergency care

| AED 550 - AED 3,000+

| Varies depending on the insurer

|

| Abu Dhabi

| Yes, for all residents

| Basic coverage including consultations, hospitalization, emergency care

| AED 600 - AED 4,000+

| Varies depending on the insurer

|

| Sharjah

| Yes, for all residents

| Basic coverage including consultations, hospitalization, emergency care

| AED 500 - AED 2,500+

| Varies depending on the insurer

|

| Other Emirates

| Generally required for sponsored dependents

| Basic coverage including consultations, hospitalization, emergency care

| Varies depending on the insurer and specific emirate regulations

| Varies depending on the insurer

|

Key takeaway: While basic coverage is mandatory across most emirates, the specific benefits and premium ranges can vary. It's crucial to research the specific requirements in your emirate and choose a plan that aligns with your needs and budget.