Save up to 30% on your Car Insurance from the Top and Most Trusted Insurance Companies in UAE with Insurancehub in Just a few minutes.

More than 10,000+ across UAE have saved more than 30% of the bills on their Previous or new Car Insurance UAE.

Free 1:1 Expert Guidance Choosing Insurance that suits you perfectly according to your needs is difficult and time-consuming while many Comparison sites help you to choose but eventually customers spend more time thinking and end up buying Insurance that may not perfectly suit their needs and Wants.

At Insurancehub we remove the GUESS work from the process and provide you with expert car Guidance completely for FREE so that you can make better decisions smartly.

Save More Money and Time You won’t believe that normally people take almost a week-long time Just to decide what Car Insurance should they buy and almost 77.6% of them still end up paying 23% more as compared to people having a personal Finance Consultant.

And that’s the reason most of our customers choose Insurancehub as we not only help you while choosing the best Insurance we also help you to save time. And on, an Avg Insurancehub Customers Save more than 30% on their Previous Insurance Bills.job loss insurance brings leading insurance solutions covering your car, home, travel and health to suit your requirements Job loss insurance UAE

Quick Support and Assistance Car Insurance is more of a personal buying asset as it protects and saves your car and you from all the damages and we know that you must be having a lot of doubts which you want to clear before you Buy and also 100% assistance after you had taken the insurance.

And for that reason, our group of experts are constantly working towards making it easy for you as we provide 100% assistance throughout your Cheapest Car Insurance in UAE buying Journey.

Trusted by More than 10000 Customers We really take pride in this statement that we are truly the most customer-centric Insurance Provider in UAE connecting customers’ real problems, goals, and needs with the best Cheapest Car Insurance in UAE policy that caters to your needs.

We Just don’t claim it our 4.7 Star ratings show what we help our customers with and why almost 76.8% of Customers end up switching to Insurancehub.

Comprehensive Car Policy and Third-Party Insurance are the two types of car insurance plans available in the market.

In the UAE, third-party insurance is the minimum motor insurance required by law. This means every vehicle owner must have this coverage to legally drive. But what does it cover? Simply put, it protects you financially if you cause an accident that damages someone else's property or injures them. This "someone else" is the third party.

For instance, if you were at fault in a collision and damaged another driver's car, your third-party insurance would cover their repair costs. It would also cover their medical expenses if they were injured. This mandatory coverage provides a safety net, ensuring accident victims receive compensation. However, it's crucial to remember that third-party insurance does not cover damage to your own vehicle.

This type of insurance is a significant part of the

UAE's motor insurance market. In fact, it makes up the largest revenue segment. This is primarily due to its mandatory nature, ensuring basic protection for all drivers. The Middle East and Africa Motor Insurance Market report estimated the market size at USD 45.58 billion in 2024.

It's projected to reach USD 68.55 billion by 2031, growing at a CAGR of 6.4%. Factors like mandatory third-party insurance, increasing vehicle ownership, and rising accident rates contribute to this growth. This rapid expansion underscores the need to understand what third-party insurance offers, and its limitations.

So, who is the "third party"? In a two-vehicle accident, it's anyone other than you (the insured driver) and your insurer. This can include several individuals:

Understanding who qualifies as a third party clarifies who your policy protects. This knowledge helps UAE drivers make informed insurance decisions. It also highlights the importance of having enough coverage to protect yourself from potential liabilities, both legal and financial. This leads us to explore the differences between third-party and comprehensive insurance.

Third-party insurance covers the other driver's expenses, but you're on your own for your vehicle repairs. This is the key difference from comprehensive insurance. Comprehensive coverage offers significantly broader protection, including damage to your own car, regardless of who caused the accident. Many comprehensive policies also include attractive benefits like repairs at authorized dealerships, roadside assistance, and protection against fire and theft. For a more in-depth look at the distinctions, review our guide on comprehensive or third party car insurance.

Imagine this: you're driving a new car in Dubai and, unfortunately, cause an accident. With only third-party insurance, you would be responsible for potentially substantial repair costs. Comprehensive insurance, on the other hand, would cover these expenses, offering significant financial protection.

This difference in coverage has a direct impact on your wallet. Third-party policies usually have lower premiums. This makes them seem appealing if you're on a tight budget. However, the lower cost can quickly turn into a significant financial burden if you have an accident and need to pay for your own repairs.

How do you determine which policy is the best fit for you? Several factors come into play:

Also Read: Vehicle insurance in Dubai

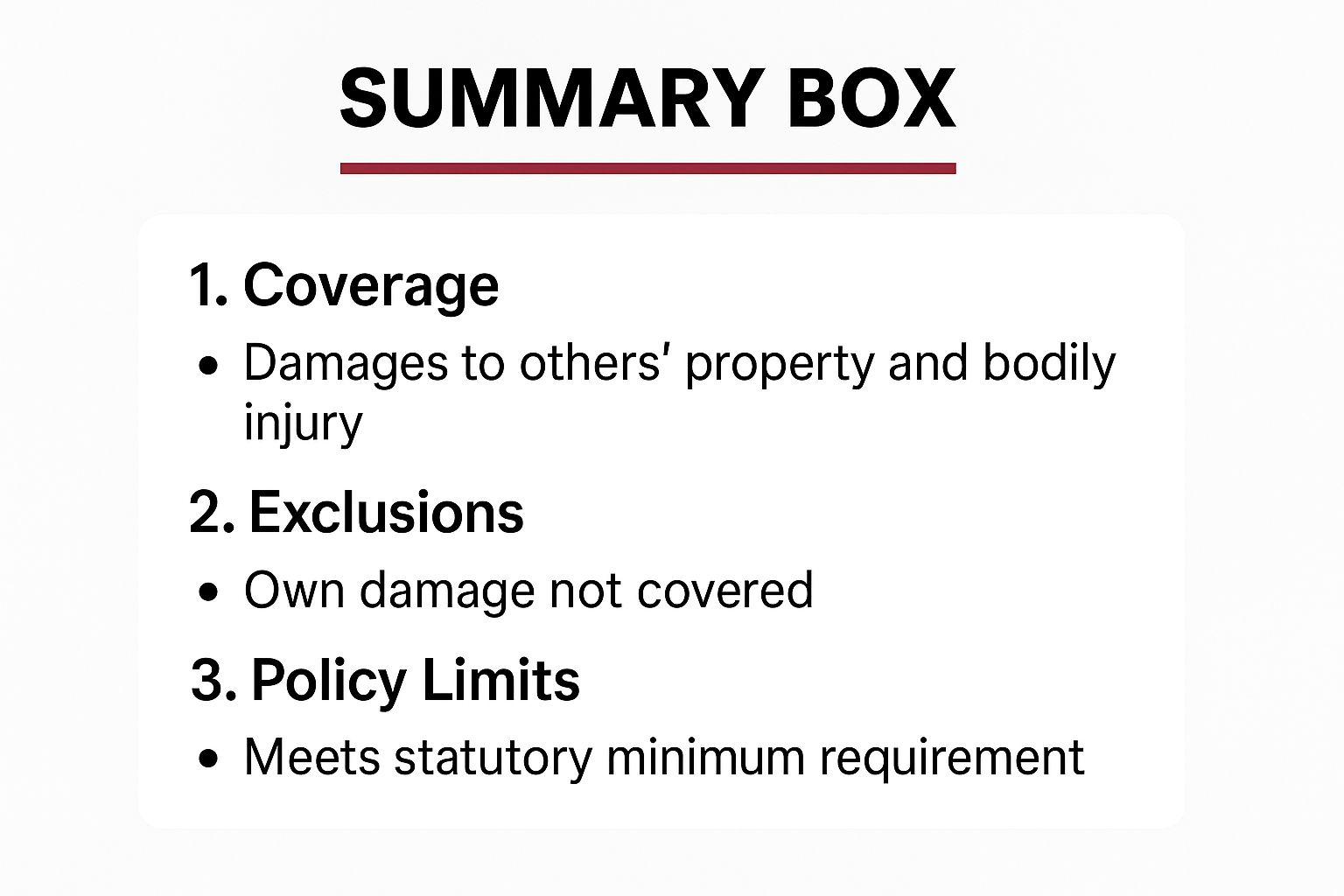

Third Party vs. Comprehensive Insurance Comparison A detailed comparison of coverage elements, benefits, and limitations between third party and comprehensive insurance policies in the UAE.

| Element | Third Party Insurance | Comprehensive Insurance |

|---|---|---|

| Damage to Your Vehicle | Not Covered | Covered |

| Damage to Third Party Vehicle | Covered | Covered |

| Third Party Injuries | Covered | Covered |

| Fire and Theft | Not Covered | Typically Covered |

| Roadside Assistance | Not Covered | Often Included |

| Agency Repairs | Not Covered | Often Included |

| Premium Cost | Lower | Higher |

This table summarizes the core distinctions. While third party insurance offers basic legal coverage at a lower price, comprehensive insurance provides significantly broader protection, including coverage for your own vehicle, at a higher premium cost.

Ultimately, the right choice depends on your personal circumstances and risk tolerance. For a deeper dive into understanding UAE car insurance, you might find this helpful: How to master.... Carefully evaluate your needs, assess the potential risks, and choose the policy that offers the best balance of cost and coverage for you. Adequate car insurance is not just a legal obligation in the UAE; it's a crucial component of financial security and peace of mind on the road.

Switching to new car insurance is almost always worthwhile. Compare more than 300 car insurance tariffs free of charge and without obligation and see for yourself how much you can save with an online contract. Up to 850 AED a year are possible!