Most Trusted Insurance Companies in UAE with Insurancehub.ae in Just a few minutes.

More than 10,000+ across UAE have saved more than 30% of the bills on their Previous or new Cheapest Car Insurance UAE.

Free 1:1 Expert Guidance Choosing Insurance that suits you perfectly according to your needs is difficult and time-consuming while many Comparison sites help you to choose but eventually customers spend more time thinking and end up buying Insurance that may not perfectly suit their needs and Wants.

At Insurancehub we remove the GUESS work from the process and provide you with expert car Guidance completely for FREE so that you can make better decisions smartly.

Save More Money and Time You won’t believe that normally people take almost a week-long time Just to decide what Car Insurance should they buy and almost 77.6% of them still end up paying 23% more as compared to people having a personal Finance Consultant.

And that’s the reason most of our customers choose Insurancehub as we not only help you while choosing the best Insurance we also help you to save time. And on, an Avg Insurancehub Customers Save more than 30% on their Previous Insurance Bills.job loss insurance brings leading insurance solutions covering your car, home, travel and health to suit your requirements Job loss insurance UAE

Quick Support and Assistance Car Insurance is more of a personal buying asset as it protects and saves your car and you from all the damages and we know that you must be having a lot of doubts which you want to clear before you Buy and also 100% assistance after you had taken the insurance.

And for that reason, our group of experts are constantly working towards making it easy for you as we provide 100% assistance throughout your Cheapest Car Insurance in UAE buying Journey.

Trusted by More than 10000 Customers We really take pride in this statement that we are truly the most customer-centric Insurance Provider in UAE connecting customers’ real problems, goals, and needs with the best Cheapest Car Insurance in UAE policy that caters to your needs.

We Just don’t claim it our 4.7 Star ratings show what we help our customers with and why almost 76.8% of Customers end up switching to Insurancehub.

Comprehensive Car Policy and Third-Party Insurance are the two types of car insurance plans available in the market.

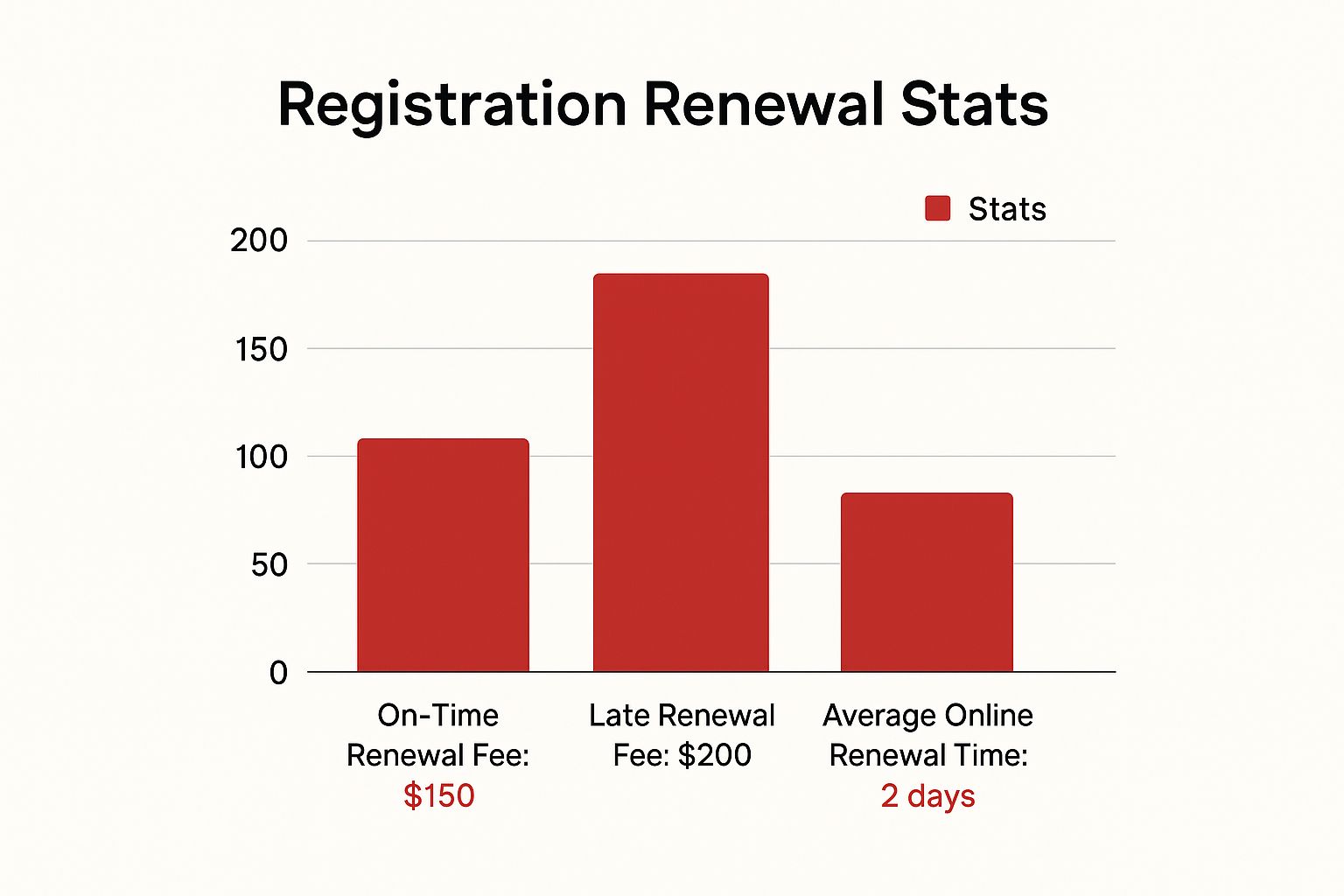

Renewing your car registration in the UAE is a yearly task. While the process is generally straightforward, understanding the steps involved can make it even easier. This section provides a clear guide to ensure a smooth and efficient renewal.

The UAE government's focus on digital services has simplified car registration renewal. Much of the process can be completed online through platforms like the RTA app or the Emirates Vehicle Gate. These digital options offer a more convenient experience, minimizing the need for in-person visits. However, understanding the steps involved is still key for a hassle-free renewal.

For a more detailed guide, check out this comprehensive resource: The Ultimate Guide to UAE Car Registration Renewal in 2025

If you prefer a completely hands-off approach, professional car registration renewal services are available. Companies like renewmycar.ae manage the entire process. They handle everything from vehicle pick-up and inspection to insurance arrangements and settling any outstanding fines. This can be especially helpful for busy individuals in cities like Dubai.

These services typically charge a processing fee between AED 250 and AED 1000, depending on the chosen package. Even with these services, securing the right insurance remains important. InsuranceHub.ae is a useful resource for comparing car insurance plans and finding the best deal.

Car Registration Renewal Fees Breakdown: A comprehensive breakdown of all standard fees associated with vehicle registration renewal in the UAE

| Fee Type | Amount (AED) | Notes |

|---|---|---|

| Renewal Fee | 350 | Covers the basic registration renewal |

| Late Renewal Fee | Varies | Depends on the duration of the delay |

| Vehicle Testing Fee | Varies | Depends on the testing center |

Regardless of how you choose to renew your registration, securing car insurance is a vital step. InsuranceHub.ae offers a streamlined online process and often provides discounts when bundled with registration renewal services. They can also help you compare different insurance plans to find the best coverage for your needs.

| Service | Pick-up & Drop (AED) | Fine Check (AED) | Registration (AED) | Insurance Arrangement |

|---|---|---|---|---|

| Standard Renewal | 300 | 50 | 50 | Free* |

*Insurance arrangement is free when purchasing insurance through InsuranceHub.ae, a channel partner. You can also get a 50% discount on pick-up and drop-off fees when purchasing car insurance through them. By using these professional services and online resources, you can simplify your car registration renewal, making it a smooth and stress-free experience.

Two primary online platforms dominate the car registration renewal landscape in the UAE: the

RTA Dubai App and the Emirates Vehicle Gate (EVG). The RTA Dubai App is primarily for Dubai residents, while the EVG caters to several other Emirates. Both platforms offer a user-friendly interface for managing vehicle-related transactions, including renewals.

The Emirates Vehicle Gate (EVG) serves as the central digital platform for managing vehicle registration and renewal across multiple Emirates. This streamlined process has significantly reduced in-person visits to service centers. Up to 60% of renewals in Dubai are now conducted online or via mobile apps, according to recent RTA statements. Explore this topic further.

While the online process is generally straightforward, some individuals prefer to outsource the entire task. Several car registration renewal services, like

renewmycar.ae>, cater to this need, offering comprehensive assistance for a fee. These services handle every aspect of the renewal, including vehicle pick-up and drop-off, inspections, insurance arrangements, fine payments, and even repairs for vehicles that fail inspection.

This offers peace of mind, particularly for those with busy schedules. These services can be especially cost-effective when considering the time and effort saved navigating Dubai's traffic and waiting in lines. The cost for these services typically ranges from AED 250 to AED 1000, depending on the specific services chosen.

| Service | Cost (AED) | Notes |

|---|---|---|

| Pick-up & Drop-off | 300 | Convenient door-to-door service. Get a 50% discount when you purchase insurance through insurancehub.ae. |

| Fine Check | 50 | Verification of any outstanding traffic fines. |

| Registration | 50 | Handling of the registration paperwork and submission. |

| Insurance Arrangement | Free* | Assistance with securing car insurance. |

Insurance arrangement is free when purchasing insurance through insurancehub.ae, a channel partner. They can also offer discounts when you purchase insurance through them.

By utilizing these online platforms and professional services, you can transform a once time-consuming chore into a quick and convenient task.

In Dubai, car insurance is usually transferable from one person to another. When you sell a car, the new owner must provide their name and contact information to the insurance company in order to continue the policy. If you do not sell your car, but instead give it away or donate it to someone, then the new owner must still provide their information to the insurance company in order to keep the policy in place

When purchasing a car insurance policy, there are a few important things to keep in mind:

- The type of car you own: Some cars are more expensive to insure than others.

- Your driving record: Your history as a driver will affect your premiums.

- The amount of coverage you need: Make sure you are fully covered in the event of an accident.

- Your budget: Car insurance can be expensive, so make sure you find a policy that fits your budget.

Comprehensive cheapest car insurance in the UAE typically costs between AED 500 and AED 2,000 per year, depending on the insurance company, the coverage level, and the driver's age and driving history.

AED 500 to AED 2,000 is a significant range, so it's important to compare quotes from multiple insurance companies to find the best price. Also be sure to ask about any discounts for which you may be eligible, such as for having a safe driving record or for being a member of a professional organization.

Yes, you need car insurance to renew your vehicle registration. If you don't have car insurance, you won't be able to renew your registration and your car will be considered unregistered. This means you can't drive it on public roads until you get insurance and renew your registration. Driving without insurance is illegal in most states, so it's not worth the risk. Make sure you have car insurance before you try to renew your vehicle registration.

Yes, you need car insurance to renew your vehicle registration. If you don't have car insurance, you won't be able to renew your registration and your car will be considered unregistered. This means you can't drive it on public roads until you get insurance and renew your registration. Driving without insurance is illegal in most states, so it's not worth the risk. Make sure you have car insurance before you try to renew your vehicle registration.Cheapest Health insurance in Abu dhabi

is essential in dealing with medical inflation if, otherwise, significant health emergencies could burn a massive hole in one's pocket.

There are a few crucial considerations to make when purchasing car insurance. The first is to make sure that you are covered in the event of an accident. The second is to make sure that you are covered in the event of theft or damage to your car. The third is to make sure that you are covered in the event of a natural disaster. fourth, Make sure you're comfortable with your policy's deductible. And fifth, review your policy periodically to ensure it meets your needs.

Yes. Car insurance premiums can be paid in installments. However, the full premium must be paid before the policy goes into effect. Additionally, some companies may charge a fee for paying premiums in installments.

There are a few things you can do to reduce your insurance premium. One is to shop around and compare rates from different companies. Another is to ask about discounts. Many insurance companies offer discounts for things like good driving records, installing anti-theft devices, or taking defensive driving courses. You can also sometimes lower your premium by increasing your deductible.

There are a few ways to get car insurance quotes. You can go online and visit different car insurance websites, or you can call up different car insurance companies and ask for quotes. Additionally, many car dealerships offer free car insurance quotes as part of the buying process.

There is no definitive answer to this question as there are many factors that can affect the cost of car insurance. Typically, though, the younger you are when you purchase car insurance, the less expensive it will be. This is because statistically young drivers are more likely to get into accidents than older drivers.

However, there are a few things to keep in mind when deciding whether or not to purchase car insurance at a young age. First, rates may increase as you get older, even if you have a clean driving record. Second, some insurers offer discounts for mature drivers, so it may be worth shopping around to find the best deal. Finally, if you do not have a driver's license or are not yet old enough

Insurancehub also provides cheapest health insurance in Abu dhabi

.

Cheapest car insurance in uae | car insurance in uae | Cheapest car insurance in uae | Best car insurance in uae | Best car insurance in uae

Switching to new car insurance is almost always worthwhile. Compare more than 300 car insurance tariffs free of charge and without obligation and see for yourself how much you can save with an online contract. Up to 850 AED a year are possible!