Demystifying Third-Party Insurance

In the UAE, third-party insurance is the minimum motor insurance required by law. This means every vehicle owner must have this coverage to legally drive. But what does it cover? Simply put, it protects you financially if you cause an accident that damages someone else's property or injures them. This "someone else" is the third party.

For instance, if you were at fault in a collision and damaged another driver's car, your third-party insurance would cover their repair costs. It would also cover their medical expenses if they were injured. This mandatory coverage provides a safety net, ensuring accident victims receive compensation. However, it's crucial to remember that third-party insurance does not cover damage to your own vehicle.

This type of insurance is a significant part of the UAE's motor insurance market. In fact, it makes up the largest revenue segment. This is primarily due to its mandatory nature, ensuring basic protection for all drivers. The Middle East and Africa Motor Insurance Market report estimated the market size at USD 45.58 billion in 2024.

It's projected to reach USD 68.55 billion by 2031, growing at a CAGR of 6.4%. Factors like mandatory third-party insurance, increasing vehicle ownership, and rising accident rates contribute to this growth. This rapid expansion underscores the need to understand what third-party insurance offers, and its limitations.

Understanding the Third Party

So, who is the "third party"? In a two-vehicle accident, it's anyone other than you (the insured driver) and your insurer. This can include several individuals:

- Other drivers: Regardless of fault.

- Passengers: In any vehicle involved.

- Pedestrians: Or cyclists involved.

- Property owners: Whose property your vehicle damages.

Understanding who qualifies as a third party clarifies who your policy protects. This knowledge helps UAE drivers make informed insurance decisions. It also highlights the importance of having enough coverage to protect yourself from potential liabilities, both legal and financial. This leads us to explore the differences between third-party and comprehensive insurance.

Third Party vs. Comprehensive: Making The Right Choice

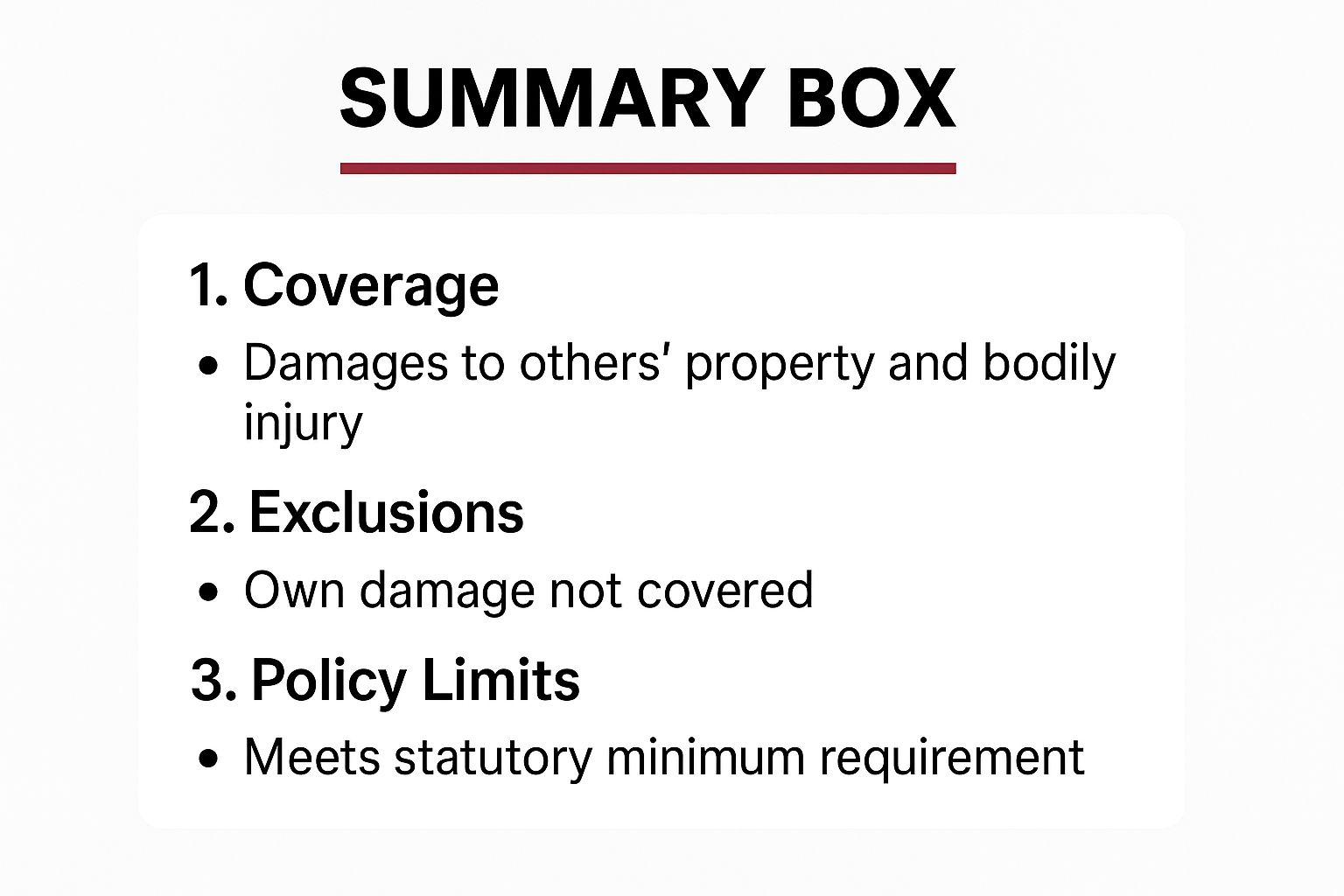

The infographic above illustrates the essentials of third party insurance. It clarifies coverage for the other person's property damage and injuries in an accident. Importantly, it highlights that this basic policy doesn't cover damage to your own vehicle. It meets the minimum legal insurance requirements in the UAE, but it leaves your own car unprotected if you're at fault in an accident.

Third-party insurance covers the other driver's expenses, but you're on your own for your vehicle repairs. This is the key difference from comprehensive insurance. Comprehensive coverage offers significantly broader protection, including damage to your own car, regardless of who caused the accident. Many comprehensive policies also include attractive benefits like repairs at authorized dealerships, roadside assistance, and protection against fire and theft. For a more in-depth look at the distinctions, review our guide on comprehensive or third party car insurance.

Understanding The Financial Implications

Imagine this: you're driving a new car in Dubai and, unfortunately, cause an accident. With only third-party insurance, you would be responsible for potentially substantial repair costs. Comprehensive insurance, on the other hand, would cover these expenses, offering significant financial protection.

This difference in coverage has a direct impact on your wallet. Third-party policies usually have lower premiums. This makes them seem appealing if you're on a tight budget. However, the lower cost can quickly turn into a significant financial burden if you have an accident and need to pay for your own repairs.

Weighing Your Options: Third Party vs. Comprehensive

How do you determine which policy is the best fit for you? Several factors come into play:

- Vehicle Value: For newer, more expensive cars, repair costs can be very high. Comprehensive insurance makes more sense in these cases, offering better financial protection.

- Driving Habits: If you're on the road frequently or often drive in high-traffic areas, your accident risk is higher. Comprehensive coverage offers greater peace of mind in these situations.

- Financial Situation: Comprehensive insurance provides more extensive protection but comes with higher premiums. Weigh your budget against the potential financial impact of an accident to make the best decision.

To help you compare, here's a table outlining the key differences:

Third Party vs. Comprehensive Insurance ComparisonA detailed comparison of coverage elements, benefits, and limitations between third party and comprehensive insurance policies in the UAE.

| Coverage Element | Third Party Insurance | Comprehensive Insurance |

|---|---|---|

| Damage to Your Vehicle | Not Covered | Covered |

| Damage to Third Party Vehicle | Covered | Covered |

| Third Party Injuries | Covered | Covered |

| Fire and Theft | Not Covered | Typically Covered |

| Roadside Assistance | Not Covered | Often Included |

| Agency Repairs | Not Covered | Often Included |

| Premium Cost | Lower | Higher |

This table summarizes the core distinctions. While third party insurance offers basic legal coverage at a lower price, comprehensive insurance provides significantly broader protection, including coverage for your own vehicle, at a higher premium cost.

Making Informed Decisions

Ultimately, the right choice depends on your personal circumstances and risk tolerance. For a deeper dive into understanding UAE car insurance, you might find this helpful: How to master.... Carefully evaluate your needs, assess the potential risks, and choose the policy that offers the best balance of cost and coverage for you. Adequate car insurance is not just a legal obligation in the UAE; it's a crucial component of financial security and peace of mind on the road.

Navigating UAE Insurance Pricing and Market Trends

Understanding UAE third-party insurance premiums is crucial for informed decisions. Pricing isn't random; insurers use specific factors to calculate your rate. These range from your driving history to your vehicle type and other unexpected elements. Let's explore this pricing structure and how these variables interact.

Key Factors Affecting Your Premium

Several factors contribute to your third-party insurance premium in the UAE. Understanding these factors helps you grasp how insurers assess your risk and determine your premium.

Driving History: A clean record means lower premiums. Accidents and violations increase your perceived risk and, therefore, your premiums.

Vehicle Type and Age: High-value cars generally cost more to insure than older, smaller vehicles due to potential repair costs for third parties. Your car's age also matters, with older models sometimes requiring higher premiums due to safety considerations.

Your Profile: Factors like your age, where you live, and even your occupation can play a role in premium calculations. Younger drivers and those in higher-risk areas may face higher premiums.

Claim History: Previous claims, even if you weren't at fault, can sometimes influence your premium. This is because some insurers may see this as a potential indicator of higher risk.

Understanding these elements offers valuable insights into how insurers determine your third-party insurance premium. This knowledge is especially helpful when comparing quotes and negotiating better rates. You might be interested in learning more about the UAE insurance market: How to master the UAE insurance market.

UAE Market Dynamics and Pricing Trends

Individual factors aside, broader market dynamics also influence third-party insurance pricing. These dynamics include the economy, regulatory changes, and regional claim patterns. For instance, increased accidents in a specific area could lead to higher premiums for everyone. Changes in regulations affecting minimum coverage levels can also impact pricing.

The Middle East insurance market, including third-party liability (TPL) insurance, is influenced by various factors. A 2022 Marsh report highlighted these influences. TPL insurance pricing remained relatively stable during the third quarter of 2022, even as global commercial insurance prices increased by 6%. Learn more about Middle East insurance market trends. This stability is notable considering the surge of up to 22% in composite insurance pricing seen in late 2020.

Smart Strategies For Securing the Best Rates

Negotiating better rates requires a proactive approach. Understanding risk assessment empowers you to present yourself as a low-risk driver. Providing a safe driving record or choosing a higher deductible can sometimes reduce your premium. Comparing quotes from multiple insurers is crucial for finding the most competitive price. Be wary of extremely low premiums, which might indicate insufficient coverage.

Mastering the Claims Process After an Accident

After an accident in the UAE, navigating the insurance claims process can be daunting. Knowing the immediate steps to take and understanding the required documentation can significantly influence the success of your claim, especially with third-party insurance.

Immediate Steps After a Collision

Ensure Safety: First and foremost, prioritize safety. Check for injuries and move vehicles to a safe location if possible.

Contact Authorities: Report the accident to the police immediately. This is a legal requirement in the UAE.

Gather Information: Exchange crucial information with all drivers involved, including names, contact details, license plate numbers, and insurance information. Don't forget to collect contact information from any witnesses, too.

Document the Scene: Take photos and videos of the accident scene, vehicle damage, and any visible injuries. This visual documentation can be invaluable later.

Don’t Admit Fault: Even if you suspect you might be at fault, refrain from admitting liability at the scene. Let the insurance companies and the police determine fault.

These immediate actions lay the groundwork for a smoother claims process. The information and documentation gathered will be crucial for filing your claim and interacting with insurance companies. For a deeper dive into this topic, check out this helpful guide: How to master third-party car accident claims.

Filing a Third-Party Claim

After securing the accident scene, the next step is formally filing a claim with the other driver’s insurance company.

Contact the Insurer: Reach out to the other driver’s insurance company to notify them about the accident. Provide them with all the gathered information.

Complete the Claim Form: Accurately and completely fill out the required claim forms, providing as much detail as possible.

Submit Documentation: Submit all supporting documents, including the police report, photos, videos, and any witness statements.

The Role of Third-Party Administrators (TPAs)

Understanding the role of Third-Party Administrators (TPAs) is essential. TPAs handle claims processing and customer service for many insurance companies. The TPA market in the Middle East is experiencing significant growth. In 2023, the market was valued at USD 2.36 billion. Projections indicate it will reach USD 4.7 billion by 2030, with an annual growth rate of 9.2%. This growth underscores the increasing complexity of insurance claims and the changing dynamics of the regional insurance market. Learn more about the TPA market. TPAs play a vital role in streamlining the claims process and ensuring efficient service.

Navigating Challenges and Disputes

Sometimes, the other party's insurer may be hesitant to pay or may offer a lower settlement than anticipated. Here’s how to address these situations:

Review Your Policy: Carefully review your insurance policy to understand your rights and coverage.

Negotiate: Clearly and firmly present your case, providing all supporting evidence to justify your claim.

Seek Legal Advice: If negotiations are unsuccessful, consider consulting a legal professional specializing in insurance claims.

Key Takeaways For a Successful Claim

Thorough Documentation: Detailed documentation is paramount. It strengthens your claim and helps prevent rejections.

Prompt Reporting: Report the accident to both the police and the insurance company promptly. Delays can create complications.

Accurate Information: Ensure all information provided is accurate and complete to avoid unnecessary delays or issues.

Persistence: Remain persistent throughout the process. Follow up regularly with the insurance company to stay informed and ensure progress.

The following table provides a clear outline of the third-party insurance claims process in the UAE:

Third Party Insurance Claims Process in the UAE

A step-by-step breakdown of the claims process, required documentation, and typical timeframes for third-party insurance claims in the UAE.

| Stage | Required Actions | Documentation | Typical Timeframe |

|---|---|---|---|

| Accident | Secure the scene, contact police, gather information | Photos, videos, witness details, other driver's information | Immediate |

| Police Report | Obtain a copy of the police report | Police report | Within a few days |

| Claim Filing | Contact insurer, complete claim forms, submit documentation | Claim forms, police report, photos, videos, witness statements | Within a few days of the accident |

| Assessment | Insurer assesses the claim and investigates liability | Varies | Several weeks |

| Settlement | Insurer approves or denies the claim and offers a settlement | Varies | Several weeks to months |

Understanding these steps and potential challenges will equip you to handle third-party insurance claims effectively in the UAE, ensuring you are prepared to protect your rights and navigate the process confidently.

Legal Consequences: What Happens Without Proper Coverage

Driving without valid third-party insurance in the UAE has serious repercussions. These consequences go beyond immediate fines and can significantly impact your driving record, legal standing, and even residency status. This section explores the escalating penalties for driving uninsured.

Immediate Penalties and Enforcement

The UAE is committed to road safety and strictly enforces insurance laws. Authorities use advanced systems to quickly verify insurance during roadside checks. Driving without insurance results in immediate fines, vehicle impoundment, and black points on your license. These penalties are the first stage of escalating consequences. Accumulating too many black points can lead to license suspension.

Accident Complications Without Insurance

Being involved in an accident without insurance creates a much more complex situation. You become liable for all damages and injuries to other parties involved. This includes significant legal and financial repercussions. You are personally responsible for covering medical expenses, vehicle repairs, and other costs, which can be financially devastating. You will also face legal action, potentially including court appearances and substantial fines. Understanding third-party insurance is critical; having this minimum coverage can help mitigate these consequences.

Long-Term Impacts and Secondary Consequences

The repercussions of driving uninsured reach far beyond the immediate aftermath of an accident. Your visa status can be affected, and you may encounter difficulties renewing your vehicle registration. Your financial reputation within the Emirates could also suffer. These secondary consequences demonstrate the broad impact of not having insurance. This is why obtaining appropriate coverage is so important in the UAE.

Case Studies and Legal Precedents

Real-world cases highlight the severity of these penalties. UAE courts strictly enforce insurance laws, with judgments often favoring insured parties. Authorities verify insurance validity during accident investigations. If your insurance isn't valid, determining liability becomes more complicated and often leads to increased penalties. These cases underscore the need to maintain valid third-party insurance.

Protecting Yourself: The Importance of Valid Coverage

Securing valid third-party insurance isn't just a legal requirement; it's essential for financial protection and peace of mind. It shields you from potentially crippling financial burdens and legal issues. Given the strict enforcement and severe consequences, maintaining valid insurance is a fundamental part of responsible driving in the UAE.

Selecting a Third-Party Provider That Won't Let You Down

Finding the right third-party insurance provider in the UAE can be tricky. Even when policies appear similar, the service and protection they offer can differ greatly. This section explores how to choose a provider that truly delivers, especially when you need them most.

Beyond the Price Tag: What Truly Matters

While a competitive price is essential, it shouldn't be your only concern. Other crucial aspects deserve your attention.

Claims Handling Efficiency: A provider’s reputation for swift and fair claims processing is paramount. Online reviews and consumer forums like UAE Insurance Authority complaints portal can offer valuable insights.

Customer Service Responsiveness: Easy communication with your insurer is key. Test their customer service channels before committing. A responsive team can make a significant difference during stressful times.

Financial Stability: A financially secure insurer provides peace of mind. Check the insurer's rating with the UAE Insurance Authority to confirm their financial strength.

Evaluating Service Quality and Digital Features

Take proactive steps to assess a provider's service quality before you need to file a claim.

Check Online Reviews: Consistent themes in customer feedback can reveal a lot. Look for patterns of excellent service or recurring problems.

Test Their Digital Platforms: A user-friendly website and mobile app are important. Do they offer convenient features like online claim filing and policy management?

Inquire About Add-ons: Third-party insurance provides basic coverage. Some providers offer extras like roadside assistance. Weigh the benefits of these additions against their cost.

Negotiating Better Terms and Understanding Exclusions

Don't hesitate to negotiate. Sometimes, a simple question can lead to better terms. A higher deductible, for example, might lower your premium.

Read the Fine Print: Understand the policy exclusions – situations where coverage doesn't apply. This knowledge can prevent unwelcome surprises later.

Compare Quotes: Gather quotes from multiple providers to compare coverage and cost. This helps you find the best value.

Choosing an Insurer That Supports You

Selecting a third-party insurance provider in the UAE is about finding a partner who will be there for you in difficult times. By researching thoroughly, asking questions, and understanding your needs, you can find an insurer that provides not just coverage, but true peace of mind.

Ready to find the perfect third-party insurance policy that fits your needs and budget? Visit InsuranceHub.ae today. Our platform simplifies comparing and purchasing insurance in the UAE. Get personalized recommendations from our experts and save up to 40% on premiums. Don't wait – protect yourself today.