Lenders in the Emirates have rolled out financial relief measures to ease the burden on retail and business customers

As the corona virus outbreak and measures to contain it cause economic ramifications across the globe, banks and regulators are stepping in to provide financial relief for retail customers and businesses.

Under a Dh100 billion economic stimulus package unveiled by the UAE Central Bank on March 14, lenders in the Emirates were ordered to “treat all their customers fairly” and grant “temporary relief” on retail clients’ loan payments for up to six months from March 15.

The Targeted Economic Support Scheme includes Dh50bn from central bank funds through collateralize loans at zero cost to all banks operating in the UAE and Dh50bn of funds freed from banks’ capital buffers.

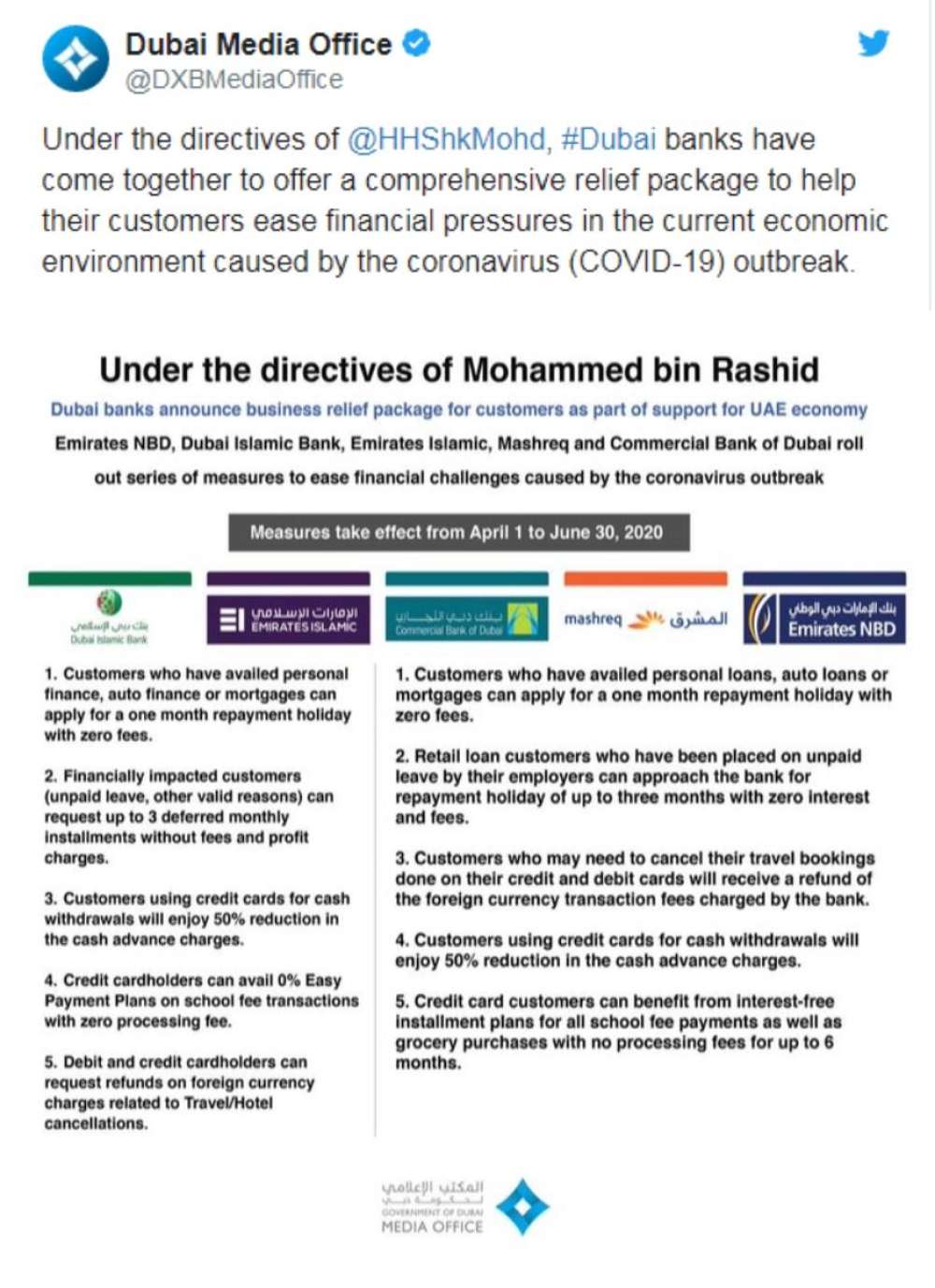

Emirates NBD, the biggest bank by assets in Dubai, along with the UAE’s largest Sharia-compliant lender Dubai Islamic Bank, Emirates Islamic, Mashreq and Commercial Bank of Dubai announced a series of support measures that will remain in effect for three months starting April 1, the Dubai government media office said on March 21.

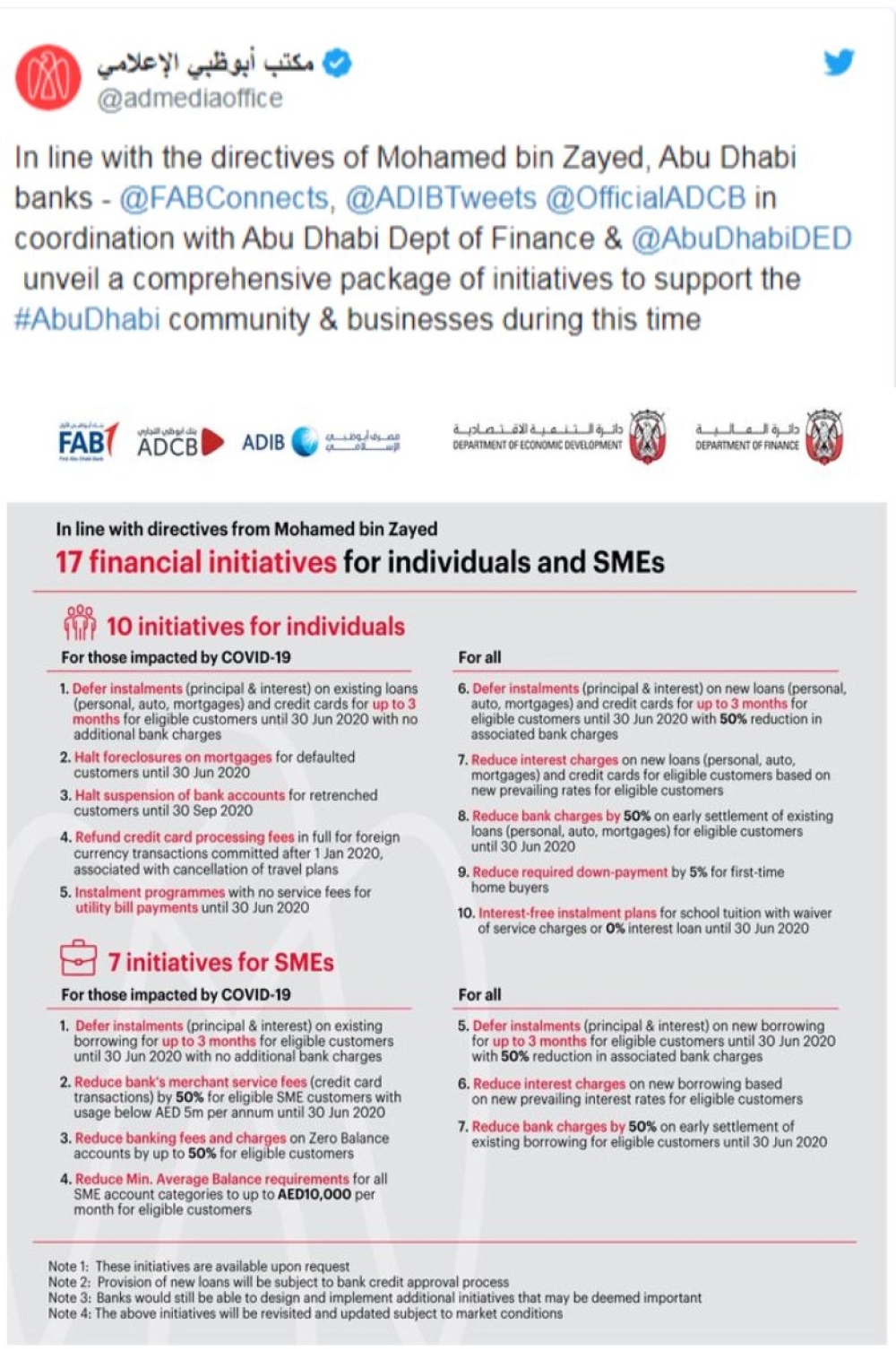

In Abu Dhabi, First Abu Dhabi Bank, Abu Dhabi Commercial Bank and Abu Dhabi Islamic Bank are offering support measures for customers. The three banks have introduced 17 initiatives to support individuals and businesses, the Abu Dhabi media office said in a tweet on Wednesday. Health insurance in uae is the one of the best health insurance branch in uae.

Elsewhere in the UAE, Ras al Khaimah’s RAKBank, Sharjah Islamic Bank and Commercial Bank International – which is based in Dubai and listed on the Abu Dhabi Securities Exchange – have also pledged to help customers.

Worldwide, there are over 425, 000 confirmed cases of Covid-19 with more than 18, 900 deaths, according to Johns Hopkins as of Wednesday. More than 109, 000 have recovered. In the UAE, there are more than 240 cases with two deaths and 45 recoveries.

Containment measures in the UAE, such as stay-at-home directives and cancelled flights, could cause a decline in revenue for businesses, and a cut in income or job losses for individuals.

“At a time like this, ensuring the UAE’s banking system’s stability is of utmost importance, ” said Ambareen Musa, chief executive of souqalmal.com. “It’s great to see banks step up and support the government and the central bank’s economic relief efforts.”

Some banks have even set up dedicated phone lines and email accounts to offer support to retail and business customers who have been financially affected by the Covid-19 crisis, Ms Musa said.

Even when there aren’t specific clauses that address your individual situation, banks are offering refinancing, repayment deferrals or lower repayments where required.

“We recognise the need to protect those most vulnerable and are committed to lending a helping hand during this uncertain time, ” said Emirates NBD chairman Sheikh Ahmed bin Saeed.

Bank branches outside shopping malls will remain open for now and ATM services are operational, but the central bank has urged customers to use digital and online channels as much as possible.

Here we outline how banks are helping consumers and businesses weather the storm.

health insurance in uae services are offered by the company insurancehub,

Emirates NBD, Mashreq, Commercial Bank of Dubai, Dubai Islamic Bank and Emirates Islamic

Individual customers:

- Retail loan customers placed on unpaid leave can ask their bank for a repayment holiday of up to three months with zero interest and fees.

- Customers with personal loans, car loans or mortgages can apply for a one-month repayment holiday with zero fees.

- First-time home buyers can benefit from a 5 per cent increase in the loan-to-value ratio (up to 80 per cent for expatriates and up to 85 per cent for UAE nationals) and a full waiver of processing fees.

- Charges on debit card cash withdrawals on the ATMs of other banks across the UAE will be refunded.

- Credit card customers can benefit from interest-free installment plans for all school fee payments as well as grocery purchases with no processing fees for up to six months.

- Customers who need to cancel travel bookings made with their credit and debit cards will receive a refund of the foreign currency transaction fees charged by the bank.

- Cash advance charges for customers using credit cards for cash withdrawals will be cut in half.

Business customers:

- Small business customers holding merchant loans, equipment loans or business vehicle loans can apply for a repayment holiday of three months with zero interest and fees.

- The monthly minimum balance required for a basic business banking account will be reduced to Dh10, 000 and minimum balance charges will be waived for a period of three months.

First Abu Dhabi Bank, Abu Dhabi Commercial Bank and Abu Dhabi Islamic Bank

Even before the Abu Dhabi media office announcement Wednesday, ADCB had introduced measures to support its 1.2 million retail customers and 50, 000 SME customers, with FAB, the UAE’s largest bank with assets of Dh822bn as of December, and ADIB following shortly after.

Individual customers:

There are five initiatives specifically for those “impacted by Covid-19” and five “for all”.

For those affected:

- A three-month payment holiday applies to existing loans and credit cards with no additional bank charges.

- Foreclosures on mortgages will be halted for defaulted customers until June 30.

- Freezing bank accounts will be stopped for customers that are made redundant or have their salaries reduced, until September 30.

- Foreign currency transactions made after January 1, associated with cancelled travel plans, will be refunded.

- Utility bills can now be paid in no-fee installment plans.

For all:

- A three-month payment holiday applies to new loans and credit cards with a 50 per cent reduction in charges.

- Interest charges on new loans will be reduced.

- Bank charges for the early settlement of existing loans will be cut in half.

- As with Dubai banks, the down-payment required for first-time buyers will be reduced by 5 per cent.

- Interest-free installment plans for school fee payments are available.

Business customers:

There are seven initiatives for business customers, including four for those affected by the pandemic and three for all.

For those affected:

- A deferment of loan payments for up to three months applies to existing borrowing.

- The bank merchant’s service fees will be cut in half for eligible SME customers with annual credit card transactions of less than Dh5m.

- Bank fees and charges will be reduced by up to 50 per cent for “Zero Balance” accounts.

- As directed by the central bank, the minimum balance for all SME accounts has been reduced to Dh10, 000 per month.

For all:

- A three-month payment holiday applies to new borrowing, with a 50 per cent reduction in charges.

- Interest charges on new borrowing will be reduced.

- Bank charges for early settlement of existing loans will be cut in half.

RAKBank

RAK Bank unveiled measures to support individuals, SMEs and corporates affected by the outbreak on Tuesday, effective immediately.

The bank said it will work with clients on a case-by-case basis to provide flexible solutions to manage challenges such as pay disruption or illness from the virus.

Individual customers:

A three-month payment holiday on car and personal loans applies, as well as a one-month payment holiday on credit card payments. The bank is offering a one-time discount of up to 50 per cent on overdue transaction fees. Customers can convert education and electronic spending on their credit cards into an Easy Payment Plan at 0 per cent interest and zero processing fees for up to 24 months.

Business customers:

RAK Bank is reducing its SME Prime lending rate and offering payment holidays for business loans or asset-backed loans for a period of up to six months. It is offering the RAK starter zero balance current account to start-ups and new entrepreneurs.

The bank’s Simplify platform will waive monthly fees over the next three months to businesses that offer essential services, such as medicines and groceries

Sharjah Islamic Bank

Sharjah Islamic Bank rolled out relief measures on Tuesday, effective from April 1.

Individual customers:

Similar measures apply. Any retail customer who has been made redundant or failed to receive their salary due to the current economic conditions can request to defer installments for three months at no charge. Payments on real estate loans can be deferred for one month.

To reduce or eliminate the need to visit branches, the bank increased the daily withdrawal limit from ATMs to DH 15, 000 for individual clients and DH 25, 000 for priority banking clients.

Business customers:

The bank reduced the minimum account balance to DH 10, 000. It “invites corporate clients to contact their relationship managers to discuss the available options” to help them mitigate the impact of the corona virus outbreak on their business, the bank said.