Understanding Medical Insurance Costs in the UAE

Navigating medical insurance in the UAE can be complex. This listicle clarifies six key factors affecting medical insurance UAE cost, helping you choose a plan that balances affordability and your healthcare requirements. Understanding these elements is crucial for securing appropriate coverage within your budget. We'll cover the Essential Benefits Plan (EBP), enhanced/comprehensive plans, network coverage, maternity coverage, deductibles/co-insurance, and pre-existing condition coverage. Make informed decisions about your health insurance with InsuranceHub.ae – compare plans and get expert advice today!

1. Essential Benefits Plan (EBP)

The EBP is a mandatory health insurance plan regulated by the Dubai Health Authority (DHA), designed for residents earning below AED 4,000/month. With annual premiums between AED 550–650, it offers coverage up to AED 150,000 for essential services like outpatient visits, diagnostics, emergency care, and maternity (with sub-limits). Pre-existing conditions are covered after 6 months, with 20% coinsurance on outpatient care (capped at AED 500 per visit)

Features of the EBP:

- Annual premium range: AED 550–650

- Maximum annual coverage limit: AED 150,000

- Coverage for outpatient consultations, referrals, and diagnostics

- Emergency treatment coverage

- Maternity coverage (with sub-limits)

- Pre-existing conditions covered after a 6-month waiting period

- 20% coinsurance for outpatient services (capped at AED 500 per visit)

Pros:

- Affordable premiums: Makes healthcare accessible for lower-income earners.

- Standardized coverage: Ensures a minimum level of protection for all.

- DHA Regulated: Guarantees compliance with quality standards.

- No age restrictions: Basic coverage is available regardless of age.

- Open to all nationalities: Accessible to all residents earning below the specified threshold.

Cons:

- Limited coverage ceiling: The AED 150,000 annual limit can be restrictive for major medical events.

- Higher co-payments: Compared to premium plans, out-of-pocket expenses can be higher.

- Limited hospital network: Fewer options for healthcare providers compared to more comprehensive plans.

- Restricted medication coverage: The formulary may not include all medications.

- Limited dental and optical benefits: These services are often not included or have minimal coverage.

Examples of EBP providers:

Orient Insurance's Basic plan (approximately AED 650 including maternity benefits)

Daman's Basic plan (approximately AED 550 for Dubai visa holders)

Oman Insurance Company's Basic plan (network coverage across DHA facilities)

Tips for Choosing an EBP:

Verify the network hospitals before selecting a provider.

Check if your employer offers any supplementary coverage that can enhance your EBP benefits.

Understand the coinsurance limits to avoid unexpected expenses

Compare different EBP providers, as services and network coverage may vary

The EBP holds a crucial position in the UAE’s healthcare landscape, offering a basic safety net for residents. While it may not be as comprehensive as premium plans, it ensures access to essential medical services, contributing to a healthier and more productive society. For those seeking more information on broader health insurance options,

learn more about Essential Benefits Plan (EBP) and other types of coverage. This is particularly relevant for UAE residents comparing health insurance plans, small business owners arranging group medical insurance, Golden Visa holders, those seeking insurance for visa stamping purposes, employees earning above AED 5,000 and their dependents, investors, expat families, and expats looking for international medical insurance in the UAE. Understanding medical insurance UAE cost begins with understanding the EBP.

2. Enhanced/Comprehensive Plans

When evaluating medical insurance UAE cost, comprehensive health plans offer top-tier coverage beyond the DHA’s Essential Benefits Plan. These plans provide higher coverage limits, access to premium hospitals, and broader benefits- making them ideal for individuals and families who prioritize quality care and lower out-of-pocket expenses.

How They Work:

Comprehensive plans involve higher premiums in exchange for extensive benefits. They typically cover specialist visits, hospital stays, surgeries, diagnostic tests, and medications. Many also include dental, optical, maternity, and wellness services, offering greater financial security and superior healthcare access

Features and Benefits:

- Premium Range: AED 3,000 - 15,000+ annually, varying based on age, coverage level, and included benefits.

- Annual Coverage Limit: Ranging from AED 500,000 to unlimited coverage.

- Hospital Network: Access to a wide network of premium hospitals and clinics, often including international facilities.

- Coinsurance: Lower coinsurance rates (typically 0-10%), meaning you pay a smaller percentage of the medical bill.

- Coverage Scope: Comprehensive outpatient and inpatient coverage.

- Medication Coverage: Extensive coverage for medications, including branded drugs.

- Additional Benefits: Often include dental, optical, maternity care, preventive care, wellness benefits, and even international coverage options.

- Direct Billing: Many comprehensive plans offer direct billing facilities, eliminating the need for upfront payments at the hospital.

Pros:

- High Coverage Limits: Provide significant financial security for major illnesses and unexpected medical expenses.

- Premium Healthcare Access: Access to top-tier hospitals, specialists, and advanced medical technologies.

- Shorter Waiting Periods: Often feature shorter waiting periods for pre-existing conditions compared to basic plans.

- Comprehensive Maternity Benefits: Enhanced maternity coverage with higher limits and broader coverage for prenatal care, delivery, and postnatal care.

- Wellness and Preventive Care: Incentives and coverage for wellness programs and preventive health check-ups.

- Direct Billing Convenience: Streamlined billing process with direct billing facilities in many network hospitals.

- Complementary Medicine: Some plans may even cover alternative treatments like acupuncture or chiropractic care.

Cons:

- Higher Premiums: Significantly higher premiums compared to basic plans.

- Age-Based Premium Increases: Premiums typically increase with age.

- Potential Exclusions: May still have exclusions for certain pre-existing conditions or specific treatments.

- Claim-Based Premium Increases: Premiums might increase based on your claim history in some cases.

- Complex Policy Terms: Policies can be complex, requiring careful review to understand the terms and conditions fully.

Examples:

Cigna: Offers comprehensive global health plans starting at AED 10,000 with worldwide coverage.

Aetna: Provides premier plans with unlimited annual coverage at AED 15,000+.

AXA: Offers comprehensive plans with dental and vision benefits at AED 7,000+.

Local Insurers: Daman Premium and Abu Dhabi National Insurance Company (ADNIC) also offer premium comprehensive plans.

Tips for Choosing a Comprehensive Plan:

Compare Networks: Carefully compare the hospitals and specialists included in different plans' networks.

Check Direct Billing: Prioritize plans with direct billing facilities for a hassle-free experience.

Understand Waiting Periods: Inquire about waiting periods for specific conditions, particularly if you have pre-existing conditions.

Review Exclusions: Thoroughly review the policy exclusions to avoid surprises later.

Consider Family Discounts: Check for family discounts if you're insuring multiple family members.

3. Network Coverage Options

Network coverage is a crucial factor influencing medical insurance UAE cost. It dictates which hospitals, clinics, and doctors you can access with your health insurance plan within the UAE. Different network tiers offer varying levels of access, directly impacting both your premium costs and the quality and range of healthcare providers available to you. Choosing the right network is a balancing act between cost and access to your preferred healthcare providers.

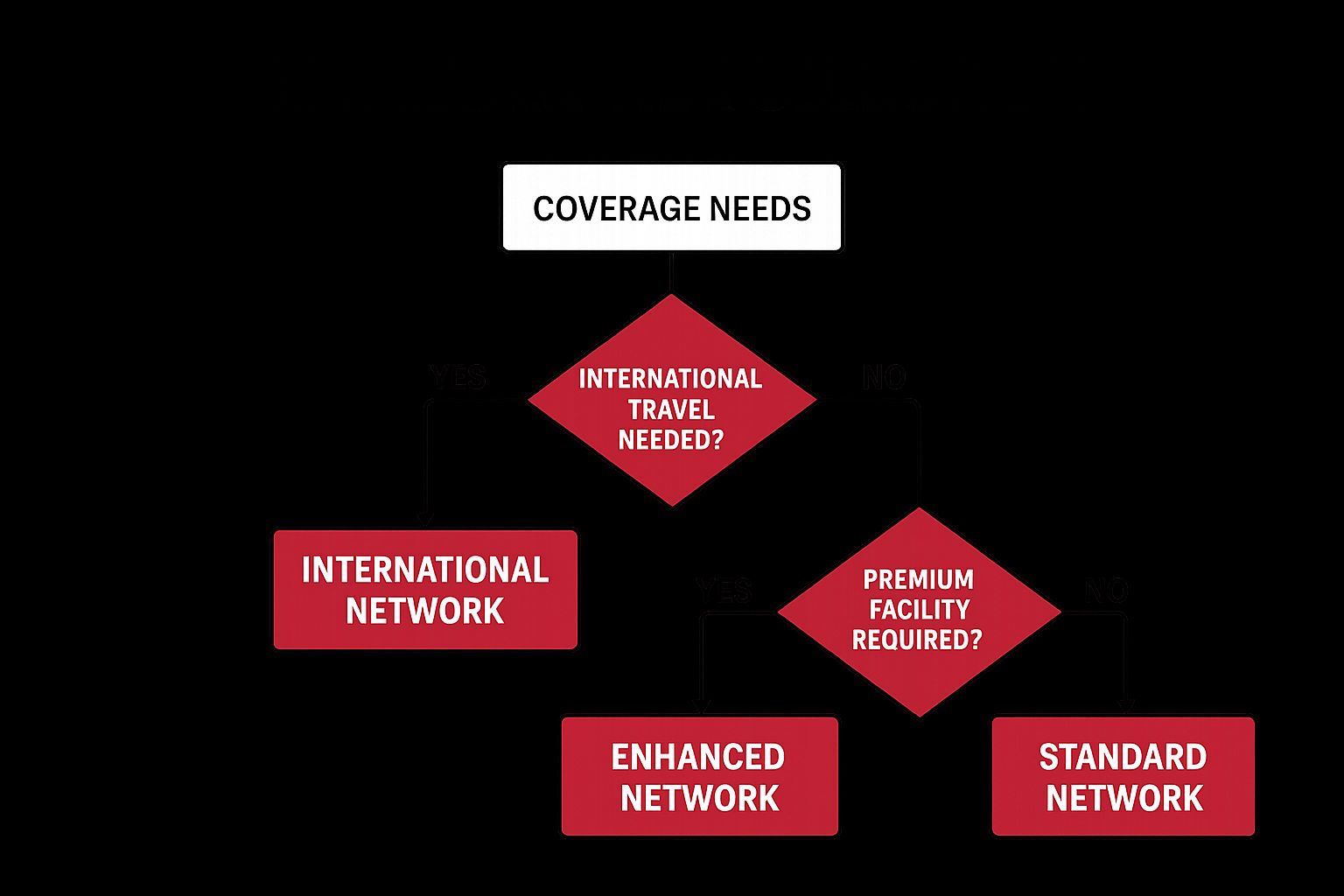

The infographic above visualizes the decision-making process for choosing a network tier, starting with budget considerations and leading to the selection of Restricted, Standard, Enhanced, or International coverage. It highlights the trade-off between cost and access to a wider range of healthcare providers.

Understanding Network Tiers and Their Impact on Medical Insurance UAE Cost:

- Restricted Network: This offers the lowest premium cost but limits you to a specific set of clinics and hospitals. This option is ideal for those on a tight budget and comfortable with the listed providers. For example, Neuron offers a restricted network plan starting at AED 900 with access to NMC facilities.

- Standard Network: Provides access to a broader range of mid-tier healthcare facilities at a moderate premium cost. This is a good balance between cost and choice.

- Enhanced Network: Grants access to premium hospitals and clinics, often including top specialists and consultants, but comes with a higher premium. Daman's Enhanced network, for example, includes premium facilities like American Hospital Dubai.

- International Network: The most expensive option, providing coverage for treatment abroad. This is suitable for individuals who travel frequently or require access to specialized treatment not available in the UAE. Oman Insurance, for instance, offers international network plans covering treatment in Europe and the USA.

Pros and Cons of Different Network Options:

Pros:

- Direct billing: Eliminates the need to pay upfront at in-network facilities.

- Customization: Network tiers allow you to tailor your plan based on your budget and preferences.

- Premium access: Higher tiers offer access to top specialists and consultants.

- Cross-emirate coverage: Some plans provide coverage across different emirates.

- International coverage: Facilitates treatment abroad.

Cons:

- Limited access: Restricted networks may not include your preferred doctors.

- Cost differences: Significant price variations exist between network tiers.

- Out-of-network challenges: Requires pre-approval and higher copays for out-of-network treatments.

- Network changes: Network hospitals may change during your policy period.

- Emergency payments: You may have to pay upfront for emergency treatment in non-network facilities.

Tips for Choosing the Right Network Coverage:

Check provider networks: Ensure your preferred hospitals and clinics are in-network before selecting a plan.

Consider geographical needs: Factor in cross-emirate coverage if you travel frequently within the UAE.

Understand out-of-network procedures: Familiarize yourself with the pre-approval process and costs for out-of-network treatments.

Local Insurers: Daman Premium and Abu Dhabi National Insurance Company (ADNIC) also offer premium comprehensive plans.

Confirm referral requirements: Determine if specialist referrals are needed within your chosen network.

Why Network Coverage Matters:

Network coverage significantly affects medical insurance UAE cost and your overall healthcare experience. Choosing the right network allows you to balance affordability with access to quality healthcare. Learn more about Network Coverage Options. Network providers like NextCare and Neuron, along with major hospital groups such as NMC Healthcare and Mediclinic, have popularized tiered network options, providing a range of choices for consumers.

4. Maternity Coverage

Maternity care is a key factor in medical insurance UAE cost. Most plans cover antenatal check-ups, delivery (normal or C-section), postnatal care, and newborn care. However, coverage varies—basic plans may have longer waiting periods and lower sub-limits, while comprehensive plans offer broader benefits but come with higher premiums. Choosing the right plan ensures quality care and better financial planning during pregnancy.

Here's a breakdown of key features:

- Waiting Period: A standard feature of maternity coverage is a waiting period, typically ranging from 6 to 12 months, before you can claim benefits. This means you need to have the insurance active well before conceiving to avoid paying out-of-pocket.

- Coverage Scope: Plans typically cover antenatal consultations, delivery charges, and postnatal care. However, the specific inclusions can vary.

- Sub-limits: Basic plans often have sub-limits for maternity benefits, typically between AED 7,000 and AED 10,000 for normal delivery. This amount may be insufficient for private hospitals in the UAE. Comprehensive plans offer significantly higher coverage, often ranging from AED 25,000 to AED 50,000, catering to higher delivery costs and potential complications.

- Newborn Coverage: Most plans cover the newborn baby for the first 30 days under the mother's policy. It is essential to add the newborn to a separate policy after this period.

- C-Section Coverage: Medically necessary C-sections are generally covered, but it's important to confirm the specific terms and conditions within your chosen policy.

- Additional Benefits: Some premium plans offer coverage for fertility treatments and congenital conditions.

Pros:

- Protection against the high cost of maternity care in UAE private hospitals.

- Coverage for essential routine check-ups throughout your pregnancy.

- Financial security for unexpected complications during pregnancy and childbirth.

- Potential coverage for fertility treatments (in some plans).

Cons:

- Waiting periods (6-12 months) necessitate planning in advance.

- Basic plans often have significant co-insurance (often 20%), increasing your out-of-pocket expenses.

- Sub-limits in basic plans may be insufficient for premium hospitals, given that normal deliveries in private hospitals can cost between AED 15,000 and AED 30,000, and C-section costs often exceed basic coverage limits.

Examples of Maternity Coverage in UAE Health Insurance Plans

Daman Enhanced plan offers AED 25,000 maternity coverage after an 8-month waiting period.

Aetna's Premier plan covers up to AED 50,000 for delivery, including complicated births

MetLife Family plan includes a AED 15,000 maternity benefit with 10% coinsurance

Tips for Choosing Maternity Coverage:

Plan Ahead: Purchase insurance well before planning a pregnancy due to the waiting periods.

Calculate Costs: Estimate potential out-of-pocket costs based on your chosen hospital and the plan's sub-limits and co-insurance.

Check for Complications Coverage: Verify if the policy covers both pre-natal and post-natal complications.

NICU Care: Confirm coverage for Neonatal Intensive Care Unit (NICU) care if required.

Add Newborn: Ensure timely addition of your newborn to a separate insurance policy after birth

Also Read:

Learn more about Maternity Coverage

Maternity coverage is a critical factor affecting medical insurance UAE cost, especially for those planning to start or expand their families. Carefully consider your needs and the specific features of different plans to make an informed decision. This is particularly relevant for expat families residing in the UAE, Golden Visa holders, and those seeking health insurance for visa stamping purposes. Small business owners arranging group medical insurance should also pay close attention to maternity benefits when selecting a plan for their employees. For employees earning more than AED 5,000 and their dependents, and for investors in the UAE, understanding the nuances of maternity coverage within the broader context of medical insurance UAE cost is essential for securing adequate protection and financial peace of mind.

5. Deductibles and Co-Insurance Structures

Understanding deductibles and co-insurance structures is crucial when evaluating medical insurance UAE cost. These cost-sharing mechanisms determine how healthcare expenses are divided between you and your insurer, significantly impacting both your premium costs and your out-of-pocket expenses when you need medical care. This is a critical factor influencing the overall cost of medical insurance in the UAE and deserves careful consideration.

How Deductibles and Co-insurance Work:

A deductible is what you pay upfront before your insurance starts helping. For example, with a AED 1,000 deductible, you cover the first AED 1,000 yourself

Co-insurance is your share of costs after the deductible. If it's 20%, you pay 20% of the bill, and your insurer covers 80%. Many plans also include co-pay caps and out-of-pocket limits to protect you from high expenses.

Features of Deductibles and Co-insurance in the UAE:

- Annual Deductibles: Typically range from AED 0 to AED 5,000.

- Co-insurance Percentages: Common rates are 0%, 10%, 20%, and 30%

- Co-payment Caps: Usually AED 50-100 per visit for basic plans

- Annual Out-of-Pocket Maximums: Offered on some premium plans

- Varying Co-insurance Rates: Different rates may apply to different services (e.g., outpatient vs. inpatient)

- Pharmacy Cost-Sharing: Often around 30% for basic plans.

- Emergency Service Co-insurance: Specific provisions apply

Pros:

- Lower Premiums: Higher deductibles and co-insurance often translate to lower monthly premiums.

- Controlled Healthcare Utilization: Cost-sharing can encourage more thoughtful use of healthcare services.

- Preventive Care Coverage: Some plans offer zero co-insurance for specific preventive services

- Comprehensive Coverage with Premium Plans: Premium plans often feature lower or no co-insurance for most services.

- Protection Against Catastrophic Costs: Caps and maximums protect you from excessive financial burdens.

Cons:

- Potentially High Out-of-Pocket Expenses: Unexpected medical events can lead to significant expenses, especially with high deductibles and co-insurance.

- Complex Structures: Understanding the intricacies of different plans can be challenging.

- Higher Co-insurance on Basic Plans: Basic plans typically come with higher co-insurance rates (20-30%)

- Medication Costs: Some medications may have higher co-insurance requirements.

- Potential Barrier to Care: Cost-sharing may discourage some individuals from seeking necessary preventive care.

Examples

Essential Benefits Plan: 20% co-insurance for outpatient services capped at AED 500 per visit.

MetLife Premium (Illustrative Example): AED 2,500 deductible with 10% co-insurance and an annual out-of-pocket maximum of AED 10,000.

Daman Enhanced (Illustrative Example): No deductible with 10% co-insurance for outpatient and 0% for inpatient services.

Tips for Choosing a Plan:

Estimate Potential Costs: Calculate your potential annual out-of-pocket costs based on your anticipated healthcare needs.

Check for Caps: Look for co-insurance caps and out-of-pocket maximums to limit your financial risk.

Understand Varying Rates: Be aware of different co-insurance rates for various service types.

Consider High Deductibles Strategically: If you're generally healthy and rarely use healthcare services, a higher deductible might be a cost-effective option.

Review Pharmacy Benefits: Carefully examine pharmacy benefits, as medication co-insurance can add up.

Also Read:

Learn more about Deductibles and Co-Insurance Structures

This structure is popularized by regulations from the Dubai Health Authority and offered by various insurance providers, enabling employers to customize benefits packages and individuals to select plans aligned with their needs and budget. Carefully analyzing deductibles and co-insurance is essential for managing your medical insurance UAE cost effectively, whether you're an expat family, a small business owner, a Golden Visa holder, or securing insurance for visa purposes. Understanding these components is key to finding the right balance between premiums and potential out-of-pocket expenses.

Almost 78.3% of Our current Customers actually choose Insurancehub because of the following reason:

Easy and Affordable way to Buy any Insurance Online

Most of our First Time customers couldn’t believe that Buying Insurance Online is as simple and affordable.

Free Expert Guidance

We help you to get the Best Deal on any Insurance at a very affordable price ( Insurancehub. ae Customers save almost up to 40% as compared to others )

Save More Time, Money, and Effort

Save more than you expect. Our Insurance Advisors will help you to find the best deals that will save you not only cover all your needs but would help you save a lot of your Money, Time, and Effort.

Saving is the Ultimate Mantra…

100% Guarantee of Premium Support

We just don’t treat our customers as Just customers rather friends. And Insurancehub is that friend who will never forget you whenever you’re in Need. We take this part of our Operations were carefully so that you get a seamless experience.

Fill out the form Complete the basic form that hardly takes 3 mins of your time.